It has been a painful 5 weeks for many UK investors with the FTSE250 & AIM indices falling 7%+ since topping out on 6th Sept.

There are multiple theories why - not least inflation, rising bond yields, profit margin compression, China, supply chain disruption & so forth. Yet most of these were known 3 months ago, & GDP is still ticking along nicely.

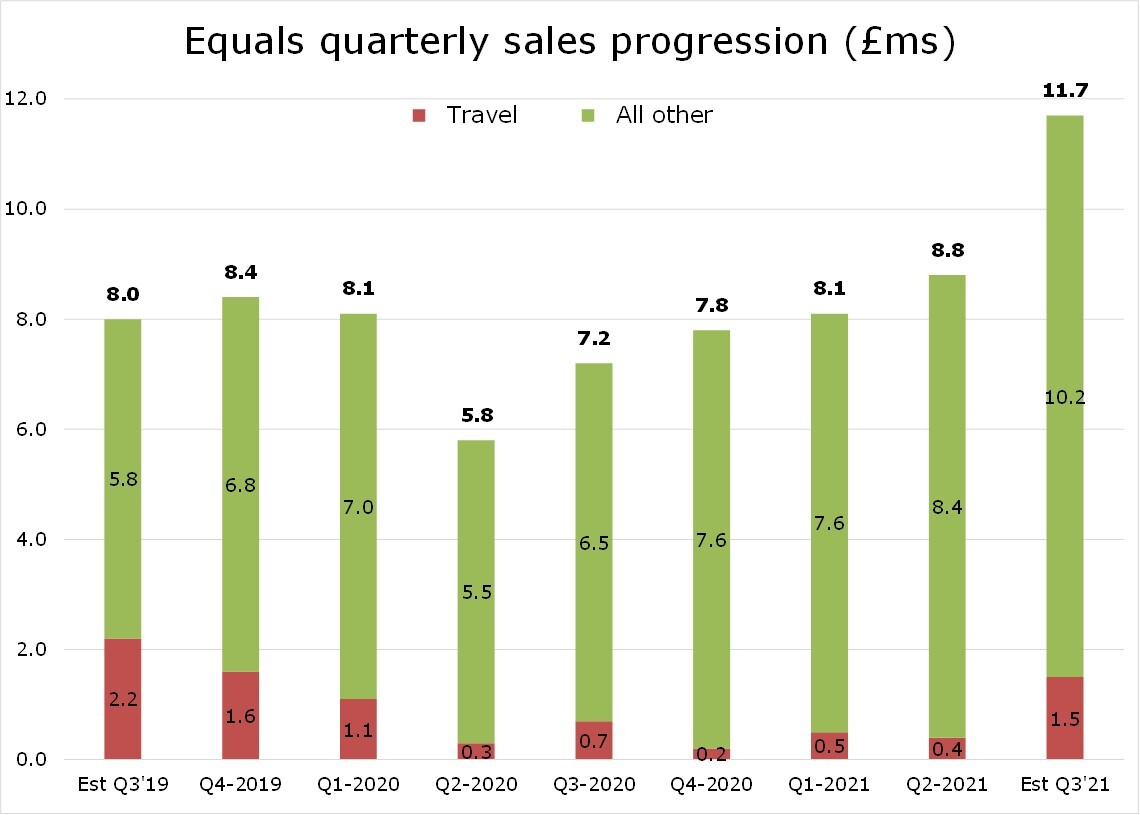

In fact today, fintech, international B2B epayments & corporate banking specialistEquals (EQLS said that top line growth (see chart) had accelerated in Q3’21 with revenues climbing 47% vs Q3’19 (pre-pandemic) to a record £11.7m (+33% sequentially). Driven by all product categories alongside strong demand for 'Equals Solutions', a new multicurrency ‘1-stop shop’ service for larger corporates.

Personally I suspect this trend will continue into Q4’21 and beyond, particularly as foreign travel reignites after the loosening UK Covid restrictions wrt the most popular tourist destinations. Indeed school half-term & Xmas holiday bookings have already soared.

Similarly given the increasing momentum & relatively modest overhead growth, then significant operating leverage (40%+ EBITDA drop through rates) should also kick in over the next 1-2 years. Which frankly could propel the stock to the next level.

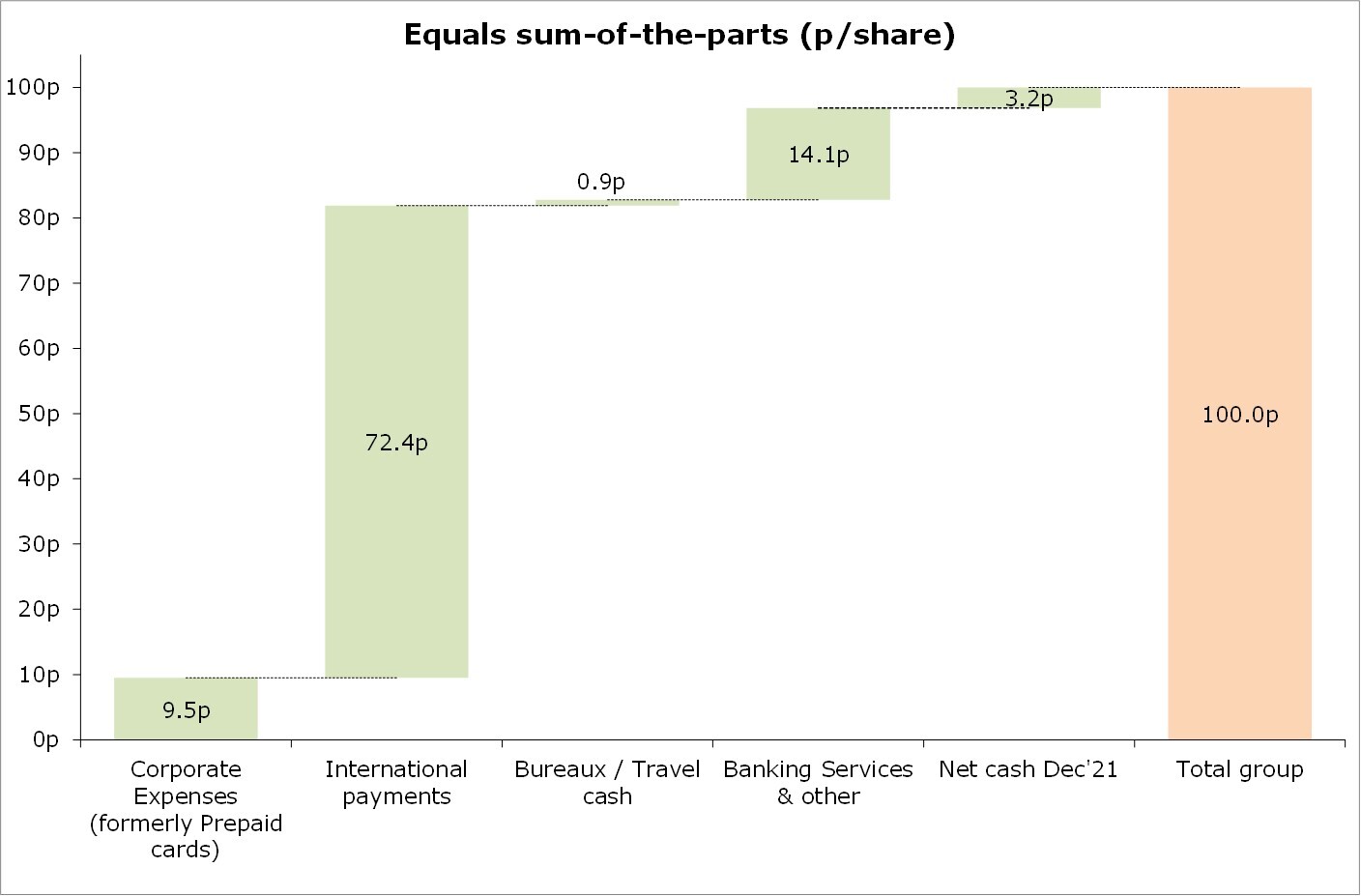

As such, I have upgraded my FY21 forecasts (Adj EBITDA of £5.3m on revs £40.0m) and valuation to 100p/share vs 78p before (see chart).

Marvellous news, & another great reason not to get too despondent about the short term gyrations of the market.