[source: Lords Group Trading]

Artificial intelligence is great, but is the tail wagging the equity dog?

Indeed it's estimated that >50% of all trades are done by algorithms - many of which are driven purely by short term newsflow. Thus creating opportunities for patient, value-based investors prepared to stomach the volatility

Such a mis-pricing event occurred in energy 2-years ago, with the same situation likely repeating itself today across UK construction. Why?

Well, despite the c. 20%-40% sell-off (vs 2021 highs), the reality is that demand still far out-strips supply, with skilled tradesman sitting on record orderbooks.

A message reiterated by industry bellwether Travis Perkins (UK’s largest builders merchant) in early March.

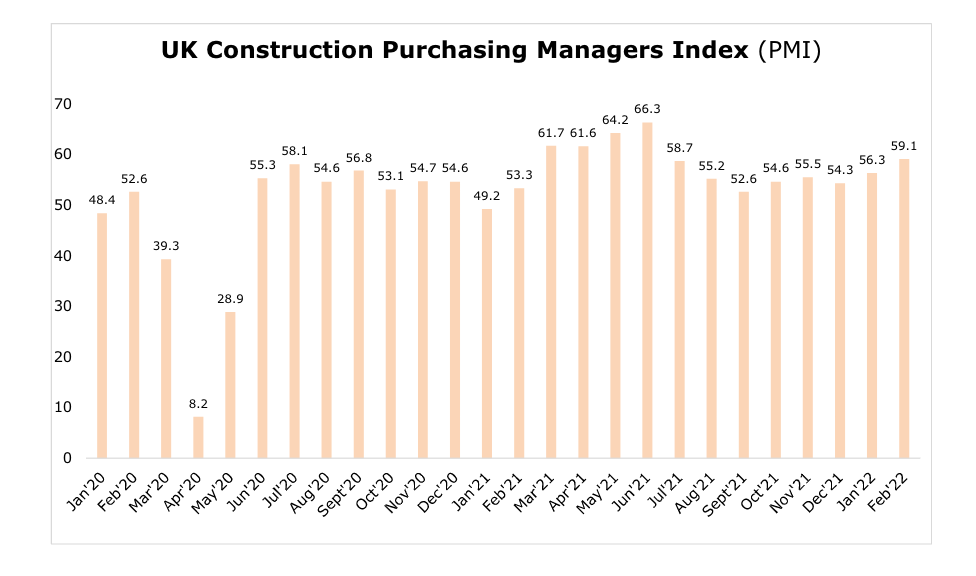

Predicting that the fundamentals remain positive (re leading indicators, PMIs) thanks to the need to upgrade ageing properties (re RMI, decarbonisation) & the shift towards premiumisation (ie nicer homes), alongside constructing lots of new houses (chronic shortage), ‘Build to Rent’, recladding & greater infrastructure spend (eg HS2, nuclear).

Sure there are concerns over inflation ultimately cooling end-user demand. Yet equally, supply chain constraints should ease later this year - thus enabling the system to naturally rebalance. DIY retailer Wickes adding this morning that “sales in the 1st 11 weeks of 2022 were up +26% vs 2019 – supported by buoyant demand from local tradesmen.”

One stock that looks perfectly suited to this environment is Lords Group Trading (LORD ). A rapidly expanding, specialist UK builders merchant (51% of EBITDA) and heating/plumbing (49%) distributor, addressing a £55bn TAM (+5% pa).

Here LORD listed in July 2021 raising £52m at 95p/share (£30m of fresh capital) in order to expand both organically & by acquisition (re industry consolidation). With the aim of delivering >£500m of turnover by 2024 (Est’21 £365m) & EBITDA margins up 2% from 4.4% LY (pre-IFRS16).

Elsewhere, 80% of revenues are derived from the resilient RMI sector (see attached charts), with the vast majority coming from local tradesmen, hardware stores, plumbing/heating merchants & construction companies (ie B2B).

All underpinned by excellent customer service, in-house technical expertise, next day delivery & an up-to-the minute order tracking solution (ie benefits client site planning).

Moreover the firm is still majority owned by a highly engaged workforce and entrepreneurial management team – glued together by a ‘service-led & can-do’ culture. Meaning to me, the stock appears significantly undervalued.

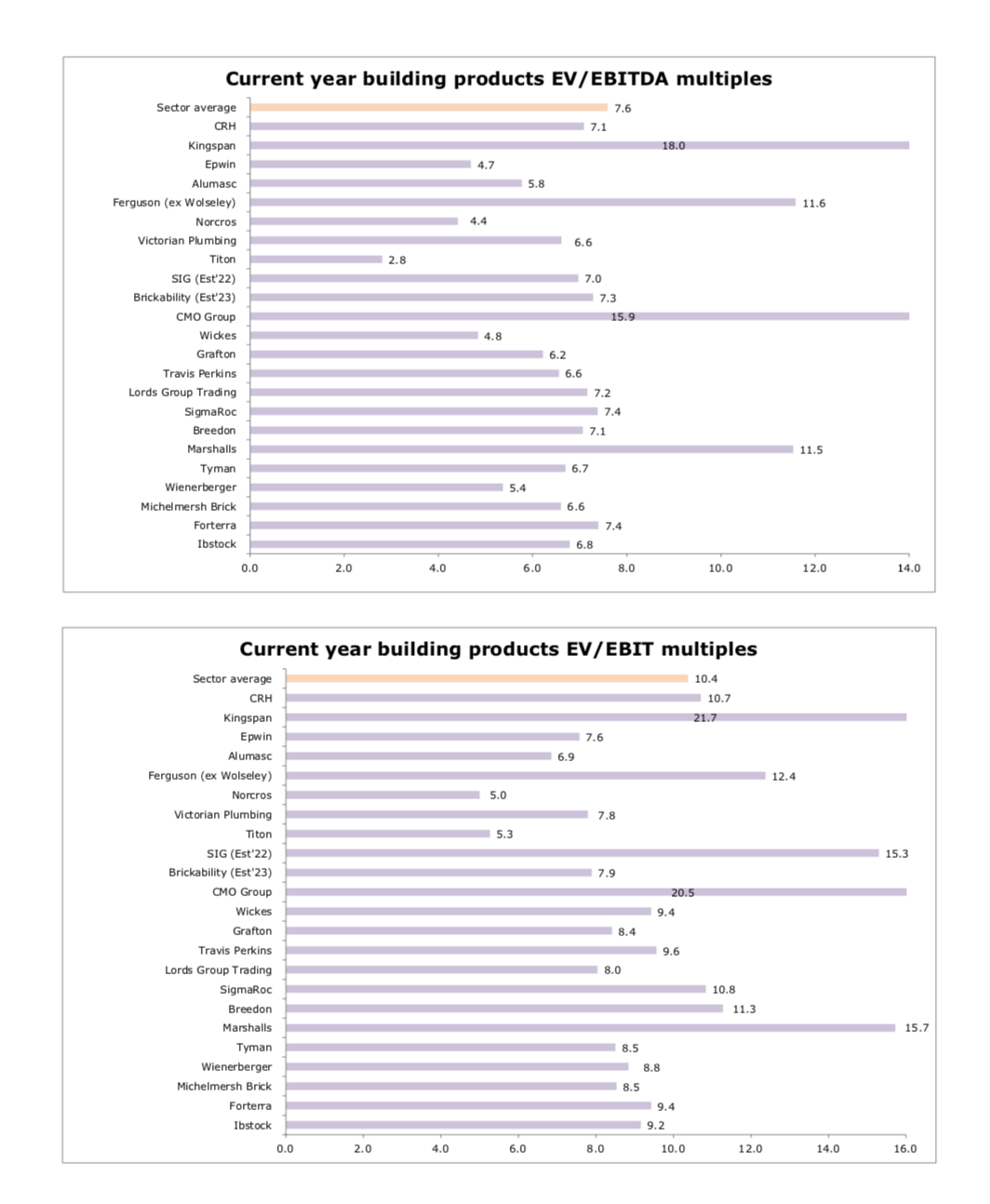

Instead, I would rate the stock on a 12x-14x FY’23 EV/EBITA (est £20m pre-IFRS, T/O £457.6m) multiple. Equivalent to c. 130p-140p/share after adjusting for Est Dec’22 net debt of £31m.

Finally, watch out for 2021 results in May, on top of more synergistic, bolt-on deals.