Following intense pressure from the media & travel sector, the government has vowed to cleanup the UK Covid testing industry.

As such, under new mandatory CTDA guidelines, all existing suppliers of PCR & RLFTs had to submit product data for a desktop validation to the UK Health Security Agency, if they wished to continue to selling from 1st November onwards.

Sure this is great news for holiday-makers, but unfortunately it appears the HSA didn’t have sufficient resource to fully implement the new rules in the stipulated timescales.

Meaning that as of today, there are only 3 fully approved tests (Roche Diagnostics, Life technologies & Clent Life Science) and another 48 (eg Oxford Nanopore) working off temporary protocols. Not surprisingly, this has impacted many firms including Avacta & Novacyt Group this morning.

In theory this should just be a timing issue, but for investors it does highlight how:

1) regulatory changes can affect even best-in-class covid screens.

And

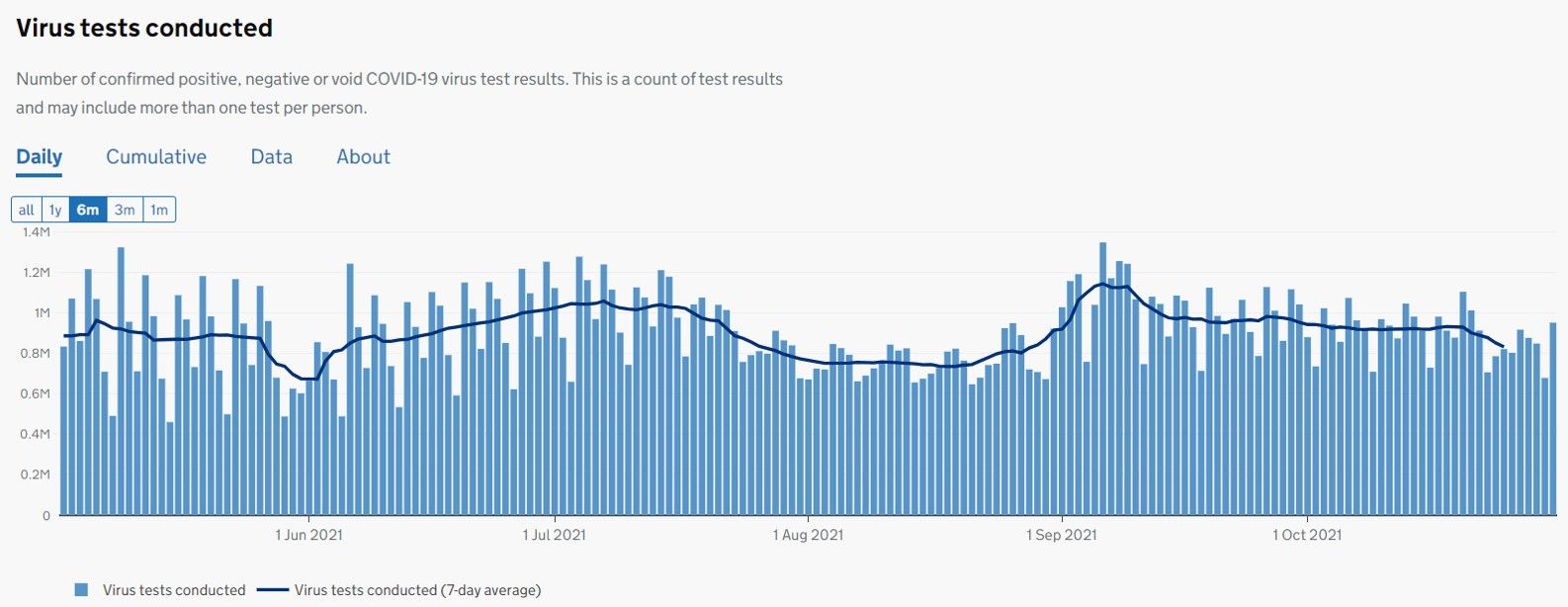

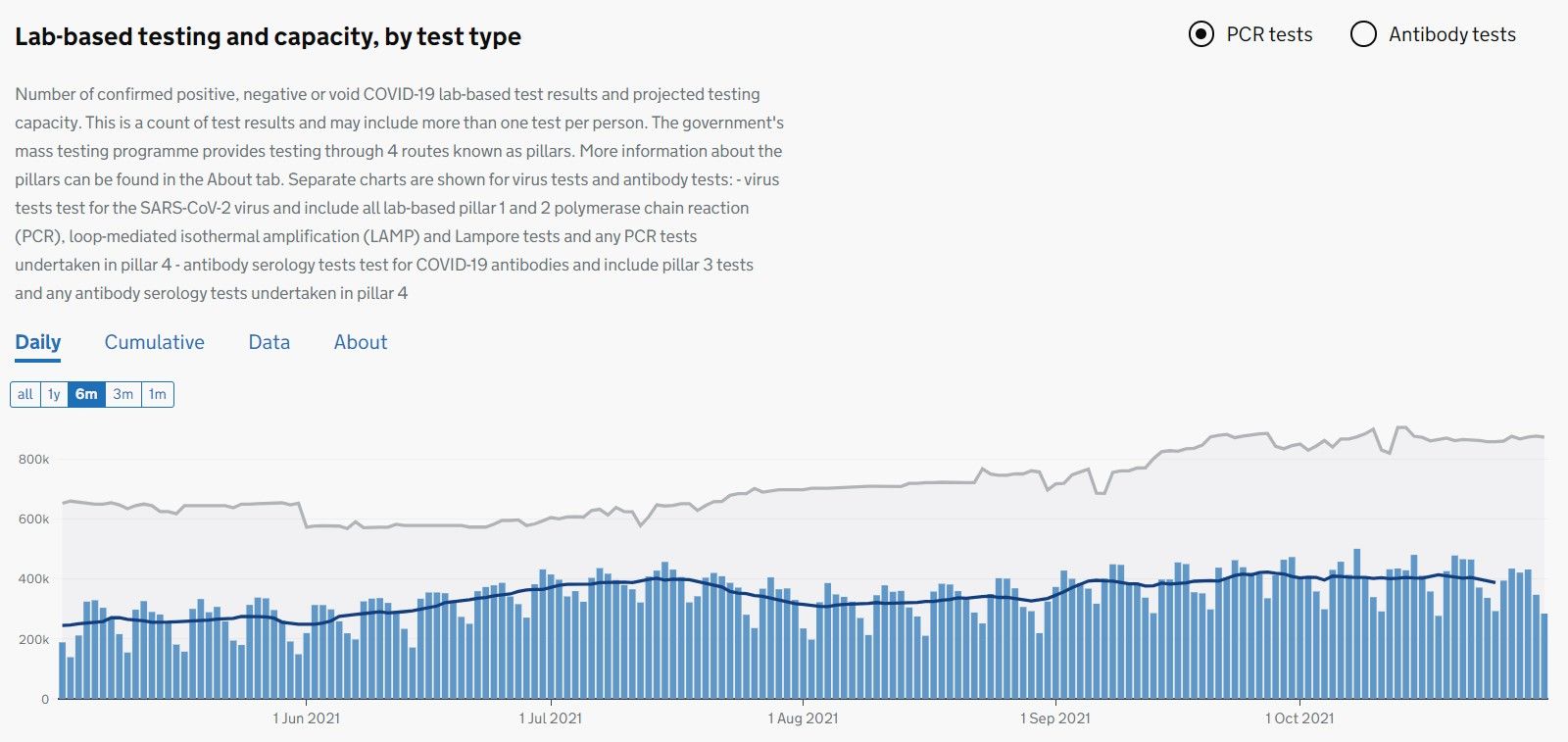

2) competitive this part of diagnostics industry has become, despite still firing on all cylinders (see stats below).

For Avacta (AVCT ) though, this UK suspension will not have a material impact its 2021 results. Instead it continues to focus on overseas opportunities for its leading AffiDX SARS-CoV-2 RLFT, including Europe & elsewhere.