One of the hallmarks behind Avingtrans (AVG )’ impressive 20%+ pa (excl divs) stock returns over the past decade has been its signature “PIE” (Pinpoint, Invest & Exit) strategy.

Not only consistently buying undervalued, niche engineering assets, but also then allocating sufficient resource & capital to successfully turn them around.

A formula that has worked many times before, and appears to be doing so again with Booth Industries, Energy Steel and Hayward Tyler. All businesses acquired at attractive prices from 2017 onwards, and now growing profitably in highly regulated, mission critical & challenging environments.

Indeed today came positive news that each had won £m+ orders, adding to their already substantial backlogs.

The first being a £6m contract for Booth to supply blast-proof doors to a Government agency operating in the UK nuclear industry. With the others providing solenoid valves & cubicle packages for the water cooling system, alongside variable drive booster pumps (re drying) at the prestigious ITER Organization project in southern France.

Here, 35 nations are aiming to build a new magnetic fusion reactor to generate large-scale & carbon-free power - ie similar to the Sun. Another major endorsement of AVG’s technical prowess, aftermarket services and overall product quality.

Wrt the numbers, Singer Capital Markets are forecasting FY22 adjusted PBT of £7.8m on £100.9m of sales - despite continuing to invest (Est £800k) in Magnetica (58% owned). A medical devices firm which is developing a ‘first-of-its-kind’ small form & cryogen free MRI scanner for the orthopaedics, neonatal & veterinary sectors (est £400m+ TAM).

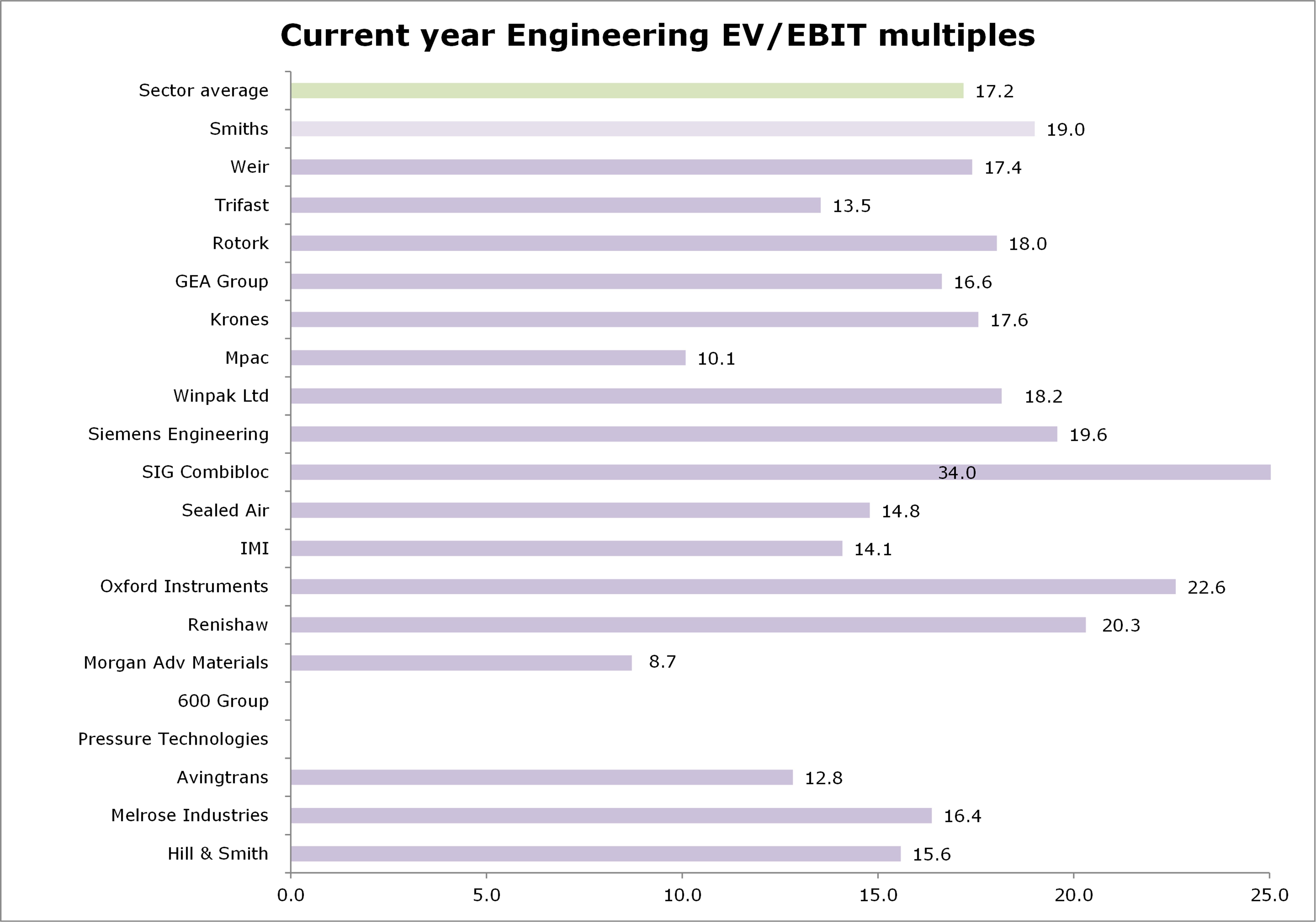

Hence, AVG shares (at 410p) trade on a modest 12.8x EV/EBIT multiple vs 17.2x for the sector (see charts).

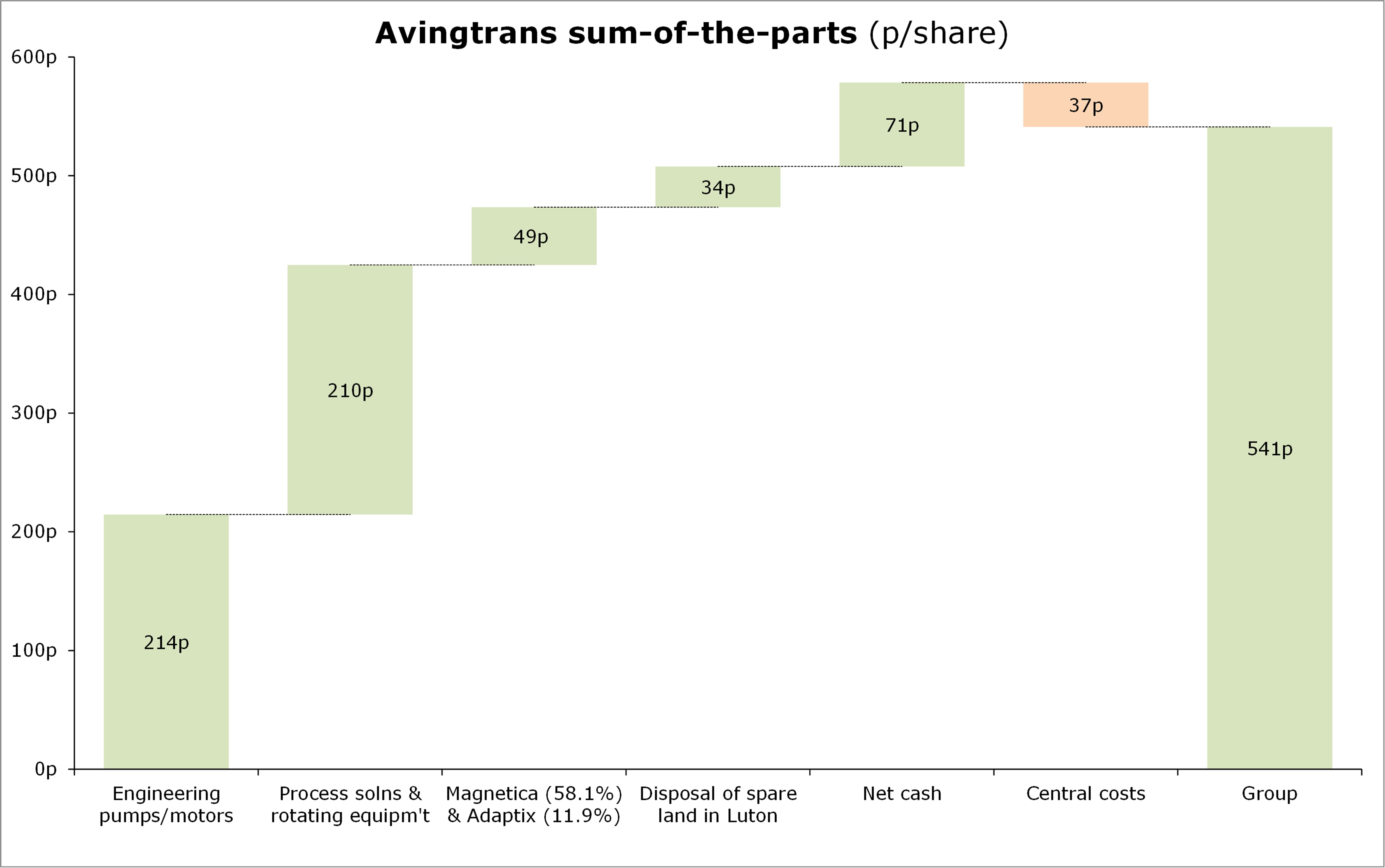

The balance sheet is rock solid too. Sporting net funds (pre IFRS 16) of £22.7m (71p/share) as at Nov’21 – with maybe another £11m coming once some spare land in Luton is sold. Offering plenty of ‘fire-power’ to continue the Board's disciplined M&A - particularly if the ongoing market volatility throws up attractive opportunities.

Finally, my ‘sum-of-the-parts’ valuation (see chart) comes out at 541p/share - underpinned by robust forward visibility, including several large, multi-year contracts.