Worried about the impact on equities of a possible Russian invasion of Ukraine?

Then one way of staying invested yet equally reducing risk, is to switch into super durable, growth stocks that have little (if any) direct exposure to the crisis. Especially those with pricing power, cast iron balance sheets, and whose demand is driven largely by regulatory & non-discretionary forces.

Enter precision engineer Avingtrans that owns several long cycle businesses enjoying niche positions in highly regulated & mission/safety critical industries.

Here its differentiated products & aftermarket services include blast proof doors (Re HS2 / submarines), ultra-secure storage boxes for nuclear waste (eg designed to last 500 years at Sellafield) and specialist pumps/motors for difficult-to-handle fluids (eg molten salt).

Elsewhere, it holds a majority 58% stake in Magnetica. A ground-breaking medical devices firm - offering significant upside potential that is developing a ‘first-of-its-kind’ small form & cryogen free MRI scanner for the orthopaedics & veterinary sectors (est £400m+ TAM).

On top, AVG has also recently doubled its stake to 11.9% in Adaptix - another pioneering, medtech and similarly exciting low-cost/dose 3D portable X-ray imaging firm aiming to transform radiology.

The ultimate objective being to ‘fuse’ both MRI & X-ray images into one user-friendly device. Thus enabling doctors/users to cheaply & quickly view full 3D graphics of say skeletal & soft tissue damage in broken bones at the point-of-care. Whilst later layering on ultrasound capability too.

So what about the numbers? Well today’s ‘in-line’ interims (Revs £45.1m & Adj PBT £3.6m) demonstrated once again the group’s resilience.

With the Board saying that AVG remains on track to hit FY22 expectations (Singer Capital Markets £7.8m PBT & £100.9m sales) - despite investing heavily in its healthcare division, and being temporarily affected by Covid related supply chain disruptions, higher input costs & contract delays.

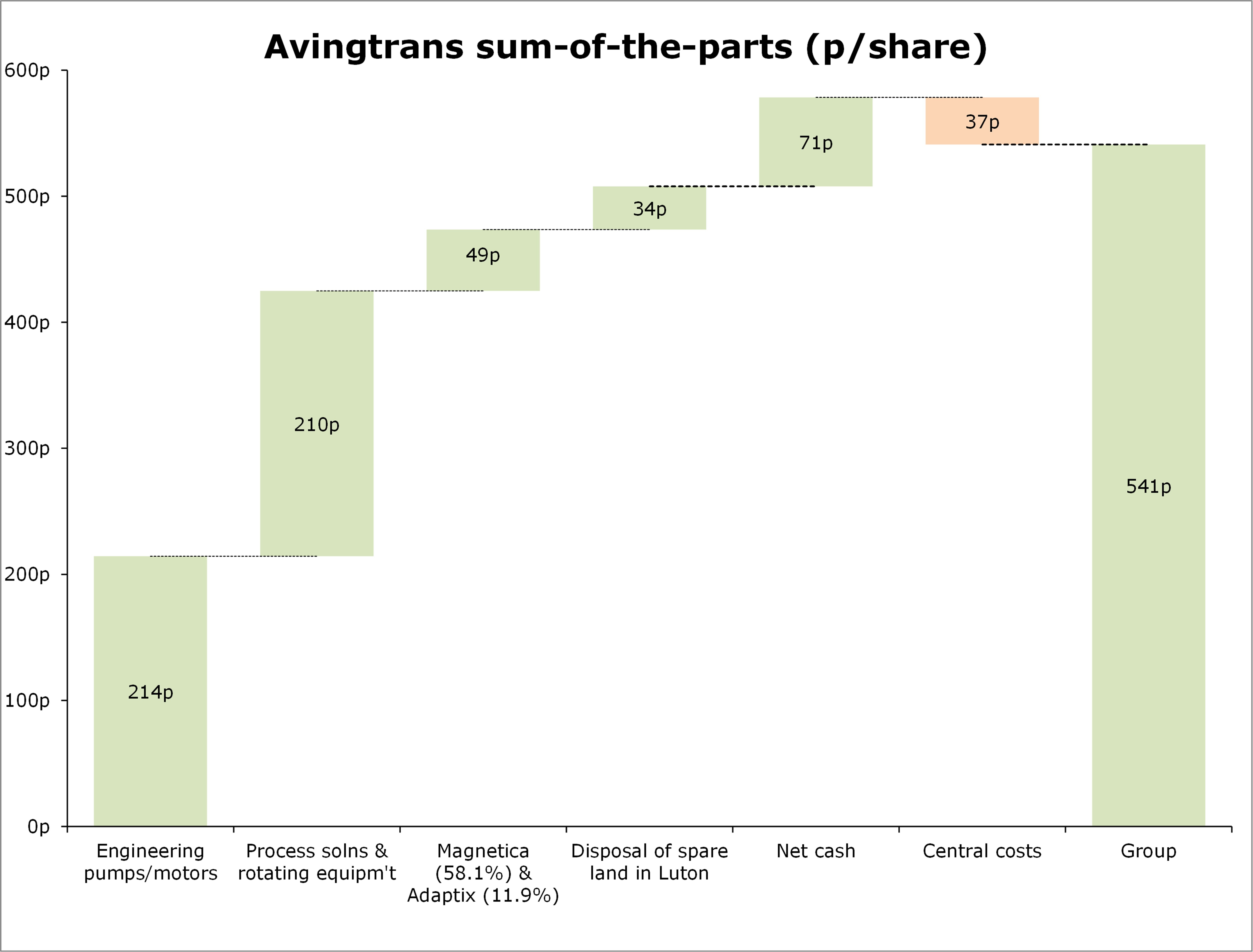

Plus net funds (pre IFRS 16) closed Nov’21 at £22.7m (71p/share) – with maybe another c.£11m coming once some spare land in Luton is sold. In turn, providing the Board with ample ‘fire-power’ to continue its disciplined ‘Pinpoint-Invest-Exit’ strategy. Particularly if the ongoing market volatility throws up attractive M&A opportunities.

Finally, my ‘sum-of-the-parts’ valuation (see chart) comes out at 541p/share - underpinned by robust forward visibility, including several large, flagship contracts.

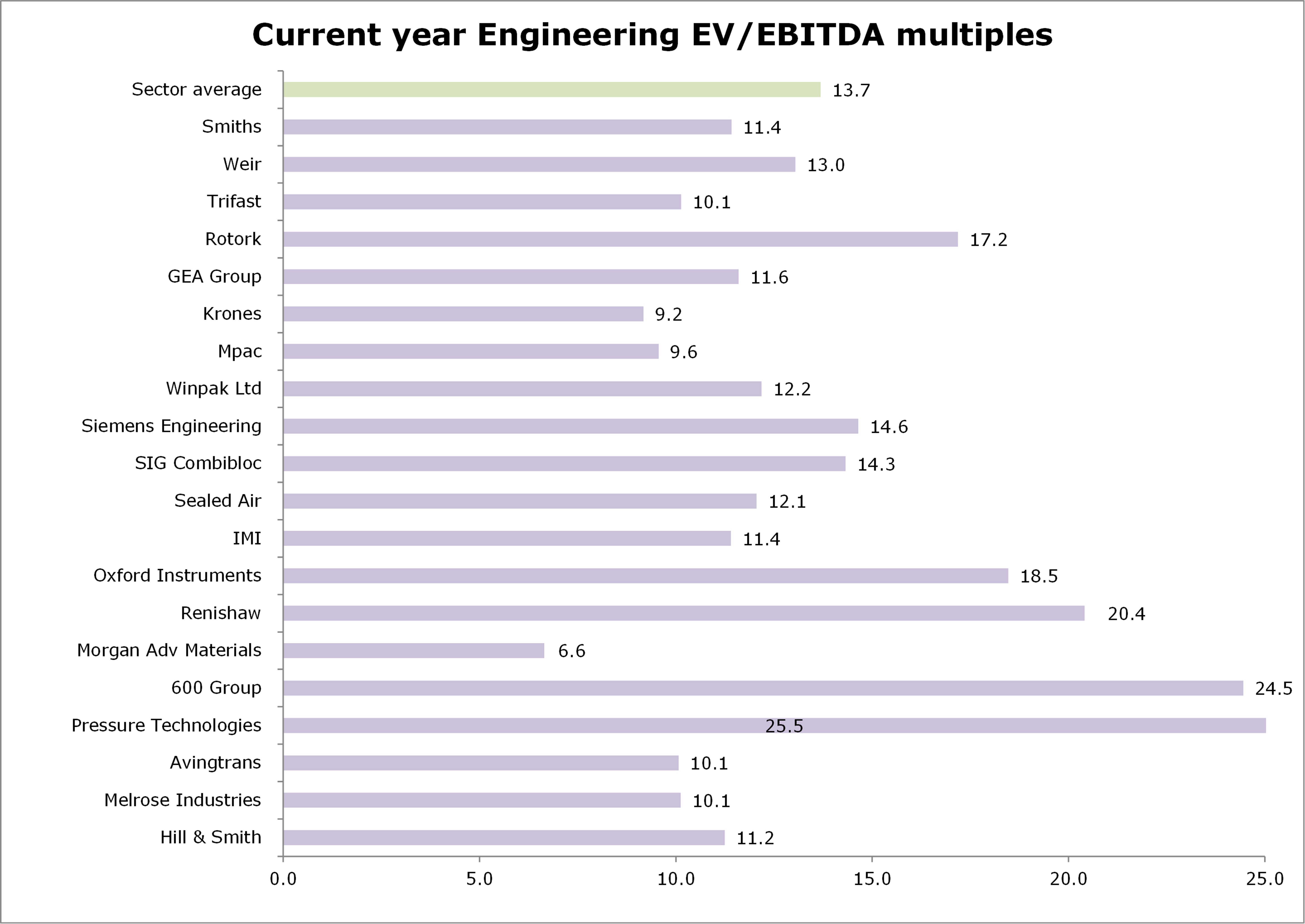

Meaning at 428p, AVG trades on modest FY22 EV/EBITDA & EV/EBIT multiples of 10.1x & 13.5x (vs sector at 13.7x & 17.3x), whilst paying a 1% dividend yield.