How are you planning to celebrate Christmas? Apart from all the gifts, turkey, drinks & trimmings, many people also treat themselves with a ‘Yule Log’. Albeit it’s often difficult hard to find a reliable source for fresh & delicious cakes? For me, problem solved though.

3 months’ ago my father ordered a Cake Box platter for his 80th birthday & was chuffed to bits with the quality & taste. Indeed given today’s similarly wonderful results, I suspect we’re not the only delighted customers either.

Here CBOX reported H1’22 adjusted EBITDA up +109% to £4.1m (£2.0m LY) on sales +92% higher at £16.5m vs £8.6m LY – driven by 68% online growth (22.7% of total) & LFL franchise sales up 13.3% to £29.5m.

Sure gross margins nudged down 2.2% to 46.1% due to accelerated store openings (+20 to 174). Yet this was more than offset by tight expense control & economies of scale, as EBIT margins climbed 3% to 22.5%. Despite industry-wide supply chain & input cost inflation pressures over the summer.

Looking ahead, October LFLs were up 14.4%, with further expansion planned in H2 as franchisees (62 deposits) open new sites, alongside expanding the kiosk concept at shopping centres & Asda, who own 630 UK outlets.

So what does this mean wrt the numbers? Well I’m forecasting FY22 turnover, adjusted EBIT, EPS & net cash of £33.5m, £6.9m, 13.8p & £6.0m respectively. Reflecting continued strong top line growth, tempered slightly by strategic investments in infrastructure, overhead, staff & distribution.

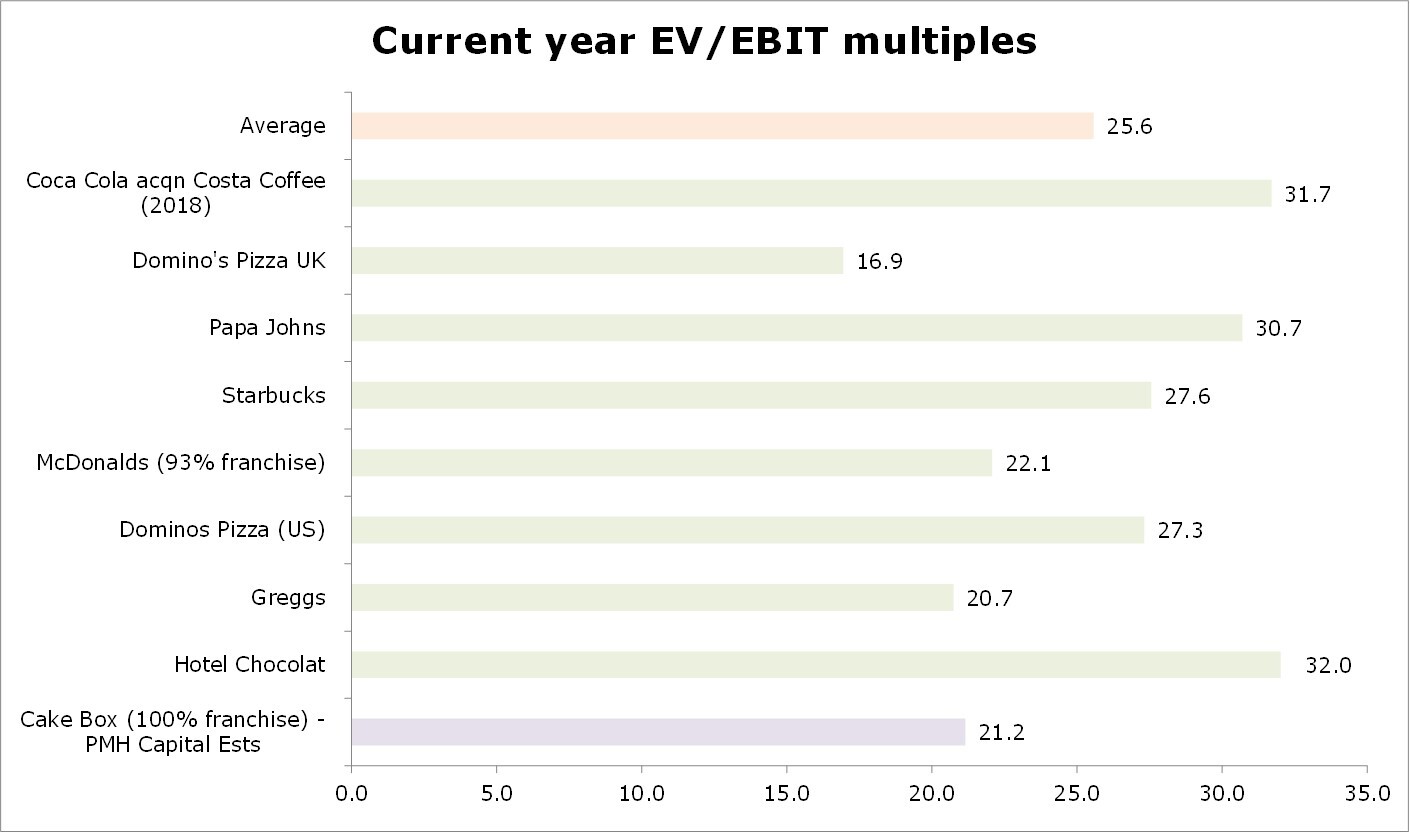

Likewise by FY27, I suspect revenues could even hit £65m (re further UK & possibly international expansion) – which assuming 22% EBIT margins & a 20x multiple (see attached) - would deliver a theoretical 715p/share valuation.

CEO Sukh Chamdal adding "We look ahead with confidence in meeting expectations and making further progress in the years ahead."