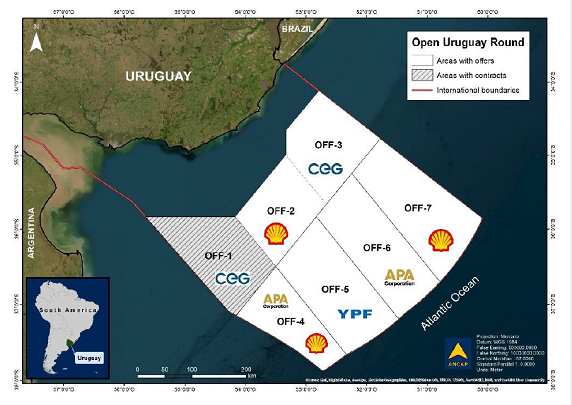

Challenger Energy (CEG ), a Caribbean and Americas-focused oil and gas producer, updated markets on its bid for the AREA OFF-3 license in offshore Uruguay.

Challenger said it expected to be awarded the AREA OFF-3 license, which is the sole remaining available block in offshore Uruguay. All other offshore exploration licences are held by energy majors Shell, Apache, and YPF, the Argentinian national oil company. The AREA-OFF 3 license is 13,252 km2, and will increase Challenger's total Uruguay acreage holdings to 28,000 km2, making CEG the second largest offshore acreage holder in Uruguay behind Shell.

AREA OFF-3 is located in relatively shallow water and has a current estimated resource potential of up to ~500 million barrels of oil equivalent (mmboe) and up to 9 trillion cubic feet gas from multiple exploration plays. As the block was held by BP until 2016, Challenger is inheriting significant modern 2D and 3D seismic, in particular 7,000km2 of 2012 vintage 3D seismic.

Uruguay offshore licence holdings

Challenger's AREA OFF-3 bid consisted of an initial 4-year exploration period, with a work programme limited to reprocessing and reinterpretation of approx. 1,000 km of 2D seismic data, similar to Challenger's successful geotechnical programme in AREA OFF-1. Challenger expects the cost of the programme during the initial 4-year exploration period to be low at approx. US$100k/year.

Industry interest in Uruguay has increased substantially following large discoveries made in offshore southwestern Africa in 2022. The expected award of this licence will solidify CEG's position as a significant participant in Uruguay, a rapidly emerging global exploration hotspot. Challenger's bid for AREA OFF-3 continues its strategy of acquiring large high-potential acreage, yet with low-cost work obligations, discretionary expenditure phasing, and no new seismic acquisition or drilling commitments.

Additionally, as Challenger is planning a farm out of its AREA OFF-1 license where it recently identified 1-2 billion barrels of oil, possession of AREA OFF-3 will be beneficial for any potential future deal or partnership, especially as there are no further offshore Uruguay licences available for award.

Challenger held a comfortable US$2.2m of unrestricted cash at the end of 2022, which should be augmented by recent asset sales.

CEG shares jumped 4.88% on the news.

Follow News & Updates from Challenger Energy: