In the same vein as Will Smith’s Oscar-winning punch on Sunday, B2B epayments platform (81% group T/O), Equals some delivered ’knock-out’ results today.

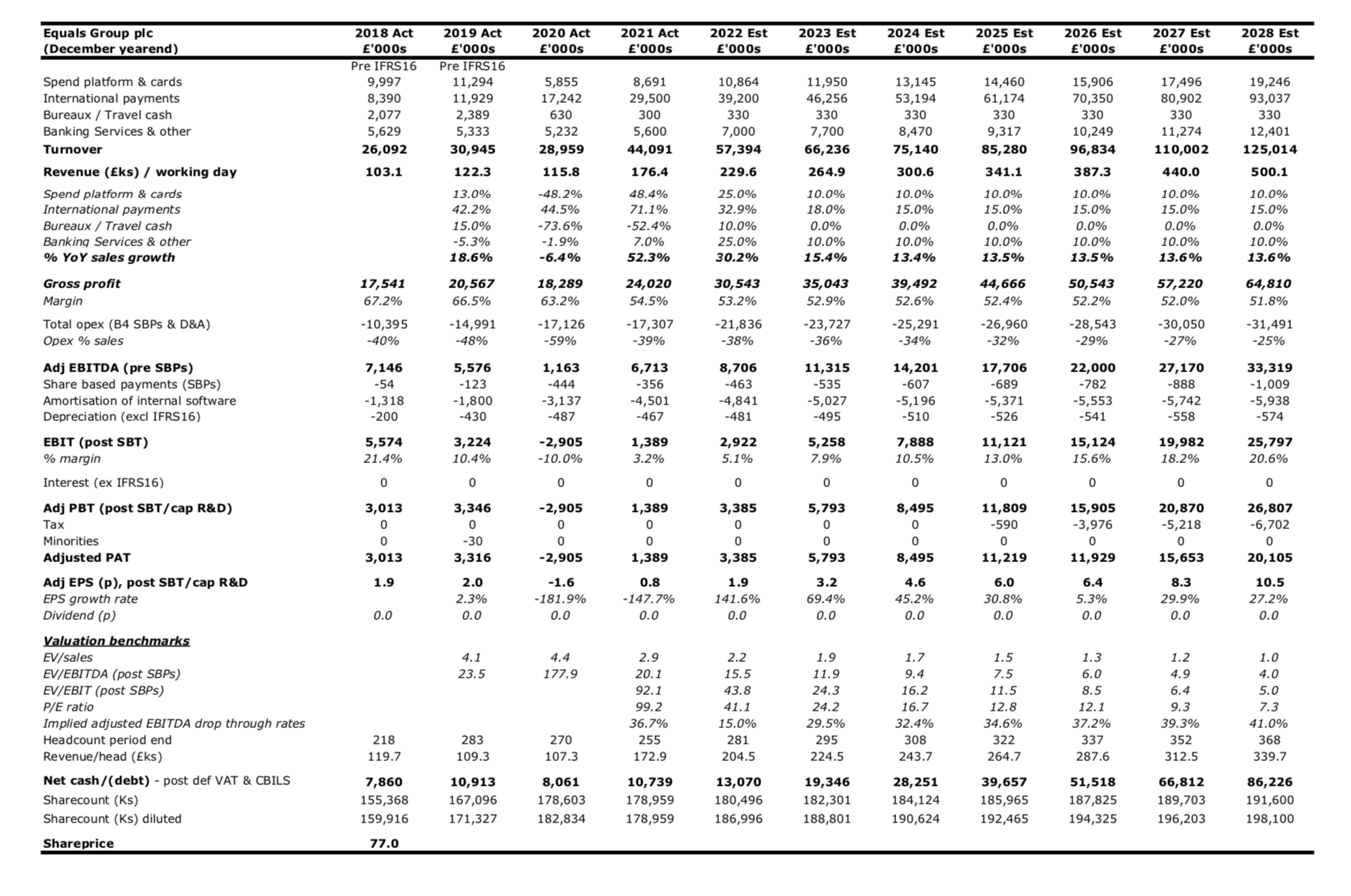

Saying that FY21 adjusted EBITDA surged 6-fold to £6.7m (£1.1m LY) thanks to a 52% jump in turnover to £44.1m (£29.0m), combined with a 7% decline in cash-based expenditure to £21.2m.

In turn driving Dec’21 net cash up to £10.7m (pre IFRS16 & post deferred VAT) - worth 5.7p/share - & providing ample capital to invest internally and via synergistic M&A.

Going forward, 2022 has started “exceptionally well” too, with YTD’22 revenues climbing 78% LFL to £13.6m due to contributions from all B2B product lines. In particular Equals Solutions (for larger accounts) has already generated sales of £2.4m vs £3.6m for the whole of LY.

Consequently, I have upgraded my FY22 sales & EBITDA forecasts to £57.4m & £8.4m respectively - despite absorbing around £2m of extra investment (re S&M, tech, etc). Similarly lifting the valuation to 130p/share – equivalent to potentially 68% upside vs 77p currently.

Here my estimates could even prove conservative, particularly if the Board manages to maintain the momentum, consumer travel returns (6% group T/O - re overseas holidays) & EQLS ultimately becomes one of the few ‘go-to challenger platforms’ for all things’ B2B forex & international payments’ related.

CEO Ian Strafford-Taylor adding: “Our platform is being adopted by existing & new customers at a faster rate than we anticipated, and that has allowed us to more quickly develop and roll-out new functionality to a broader range of customers."

"We are making excellent progress in the early stages of 2022 with rapid growth continuing, while we navigate the geo-political backdrop. We remain highly confident for our prospects both in 2022 and beyond.”

Exciting times ahead.