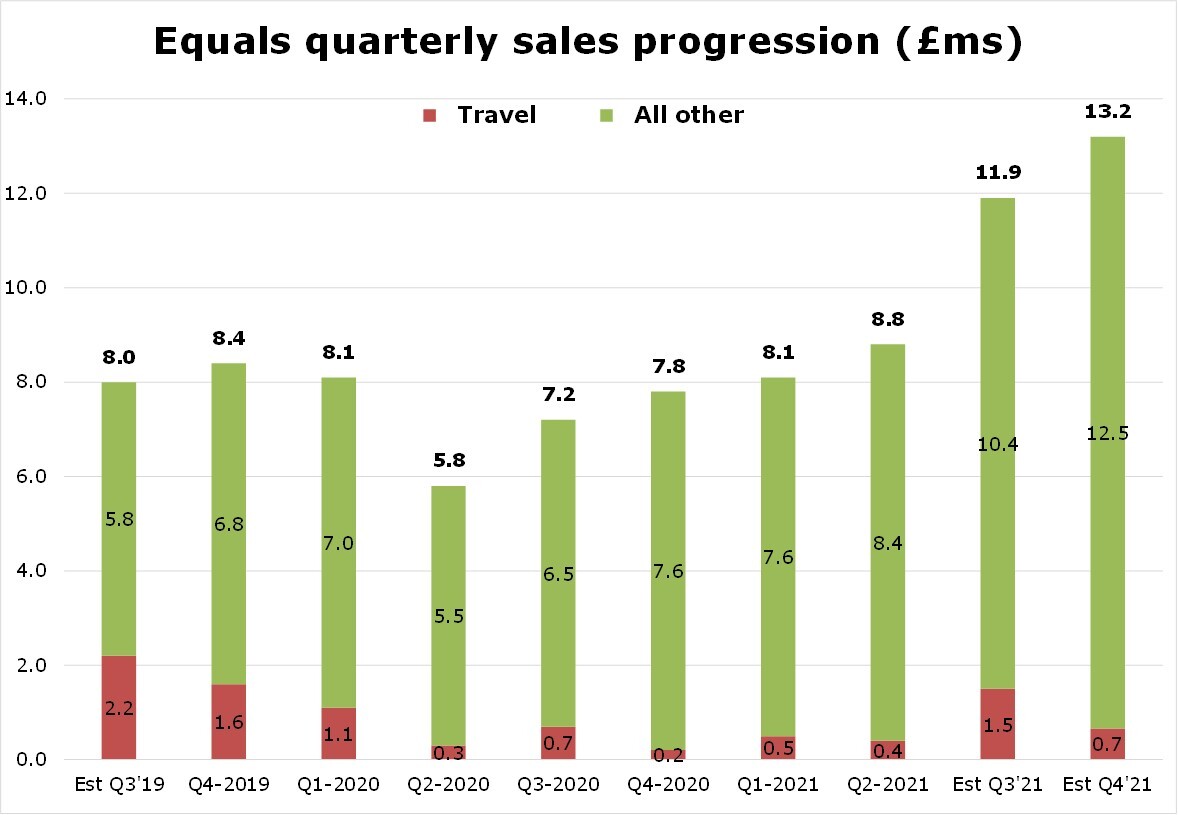

Don’t you just love management teams that revel in beating tough financial targets. In early July, I teased Ian Strafford-taylor - CEO of B2B epayments platform Equals Money – about delivering a £10m revenue quarter sometime in 2022. Job done 3 months later.

Likewise in Sept, I again jokingly asked Ian about posting a £12m quarter sometime in late 2022. Today came news that Q4’TD sales (1st Oct-6th Dec) had already hit £11.6m (+105% vs £5.7m LY) with 3 weeks to go before y/e (see charts).

The growth being driven by standout performances from ‘Equals Solutions’ - a new multicurrency service for large corporates – alongside white label partners (eg HomeSend) & increased activity in B2B 'Spend' (eg expense mgt).

What’s more, even after stripping out the £1.5m one-off forex transaction, Q4’21 revenues are still running at >£1m/week. And that’s before any noticeable uplift (5% of group) from consumer related travel (FairFX), which should come back next year in line wither overseas holidays.

Meaning all told, FY21 revenues (£40.4m YTD vs £26.8m LY) & adjusted EBITDA are now predicted to “significantly exceed expectations” vs Canaccord Genuity Group Inc.’s previous estimates of £36.6m & £5.0m respectively.

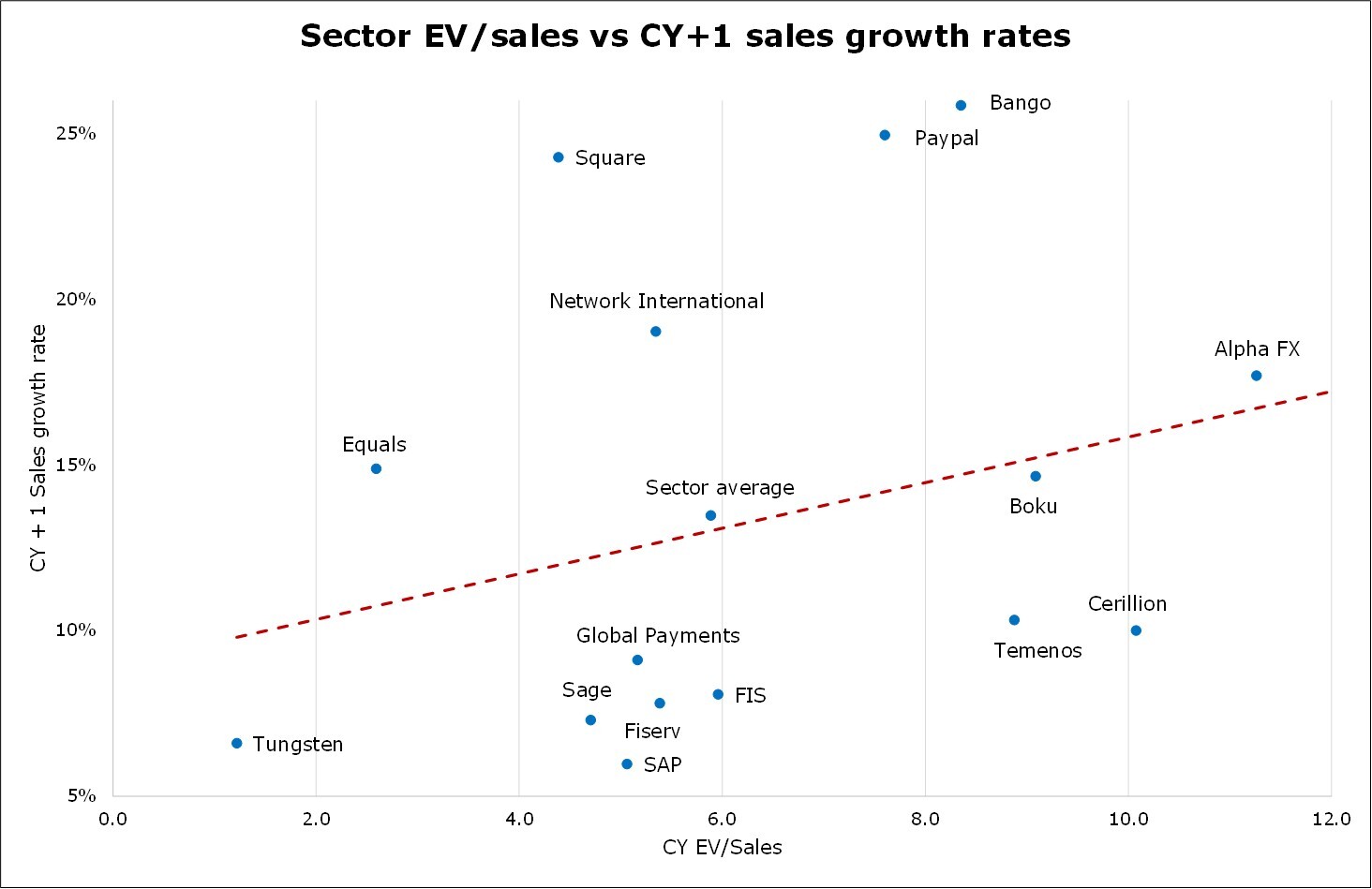

Similarly, I have upgraded my 2021 adjusted EBITDA to £5.7m (£1.2m LY) on sales of £42.0m (+45% vs £29.0m LY). Climbing to £48.25m (+14.9%) & £8.5m (+49%) 12 months later (see charts), reflecting EQLS's positive momentum, favourable operating leverage & bank grade technology. In turn, pushing up the valuation from 100p to 111p/share.

CEO Ian Strafford-taylor adding: "The strong performance we saw in September & October has continued, and allowed us to significantly surpass FY21 expectations. In order to drive further growth [we will] continue to re-invest & upgrade the sales functions". IMO, a winning strategy.

So coming back full circle. The final $64m ‘challenge’ for Ian is whether Equals Money can possibly hit £50m of turnover in 2022? Given the £1m/week run-rate & management’s track-record, I certainly wouldn’t bet against it!

Plus at 64p, the stock still looks marvellous value – trading on 2.6x EV/sales (sector >5x), falling to 2.3x for 2022.