Having navigated some choppy seas in 2021, the Venture Life VLG ship has turned itself around & is now sailing full steam ahead.Reporting today that FY21 results (sales up +8% to £32.6m) would be in line with consensus of £6.3m-£6.5m in EBITDA on revenues of £32m.Better still the orderbook is “significantly ahead of LY” - underpinning 2022 turnover & EBITDA analyst forecasts of £40.5m-£41.3m and £8.1m-£8.7m respectively.

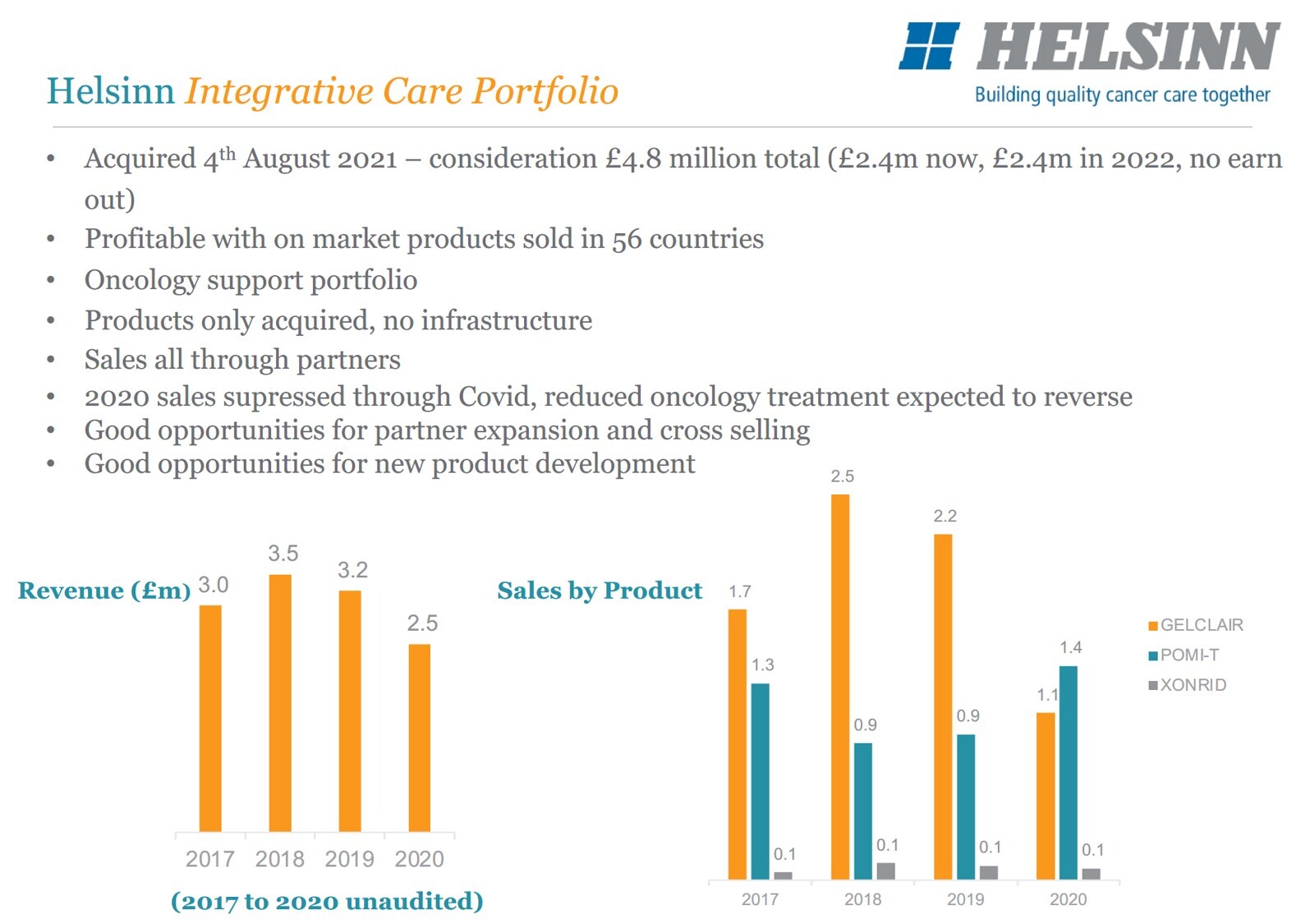

Here VLG’s OTC consumer healthcare products saw H2’21 sales climb 35% sequentially to £18.7m vs H1’21. Driven by strong underlying demand at BBI Healthcare & Helsinn Group, alongside growth from made-to-order, customer partnered brands (eg Bayer).Leaving Dec’21 net debt (pre IFRS16) at a comfortable £3.2m (or 0.4x FY22 EBITDA) vs a proforma Jun’21 position (ie post acqns) of £3.4m.

Elsewhere EBITDA margins also rose from 14% in H1 to an estimated 23% in H2, reflecting favourable product mix, operating leverage and higher gross margins.

But that’s not all.........

On top of the momentum, VLG is also launching a number of other exciting initiatives. Not least:

1) ‘white labelling’ some of its lesser known brands (eg to treat Rosacea) with several large health & beauty retailers

2) progressing an aggressive expansion plan for its leading prostrate cancer management product Pomi-T

3) targeting a minimum of £1m of sales this year in China, where new distributor Samarkand Global has recently been appointed.Wrt valuation, at 38p the stock trades on a modest <6.5x 2022 EV/EBITDA multiple compared to typical OTC branded firms at 15x-20x

In fact only 2 weeks’ ago, Unilever offered GSK £50bn (equivalent to 20x EBITDA) for its much bigger, yet slower growing consumer healthcare division.

Little wonder therefore that astute investor Simon Thompson of Investors' Chronicle sees the attractions too - particularly vs his 100p price target & Cenkos Securities plc’ upside scenario of 127p/share..

CEO Jerry Randall adding: “The acquisitions [ie £36m for BBI & £4.8m Helsinn Group] we made are now fully integrated and have performed extremely well, contributing significantly to our strong growth in revenue & profitability in H2. We have started 2022 with an order book significantly ahead of LY, giving us a good level of confidence for the year ahead.”