In December, legendary investor Christopher Mills of Harwood Capital told me there are many ways of making money. But if you want to generate serious capital, then it is usually necessary to hold companies for years through thick & thin.

To me his makes perfect sense, particularly where the fundamentals remain intact - even during extremely challenging periods.

Take Northbridge Industrial (NBI ) whose premium loadbanks test/commission backup power supplies that are critical for keeping the lights on & the internet working during blackouts (re greater grid instability due to climate change, wind, solar, etc).

I began buying NBI back in 2018 & haven’t sold any since. Indeed after seeing the price drop to 65p in Apr’20, its now recovered to pre-covid highs thanks excellent execution and self-help measures.

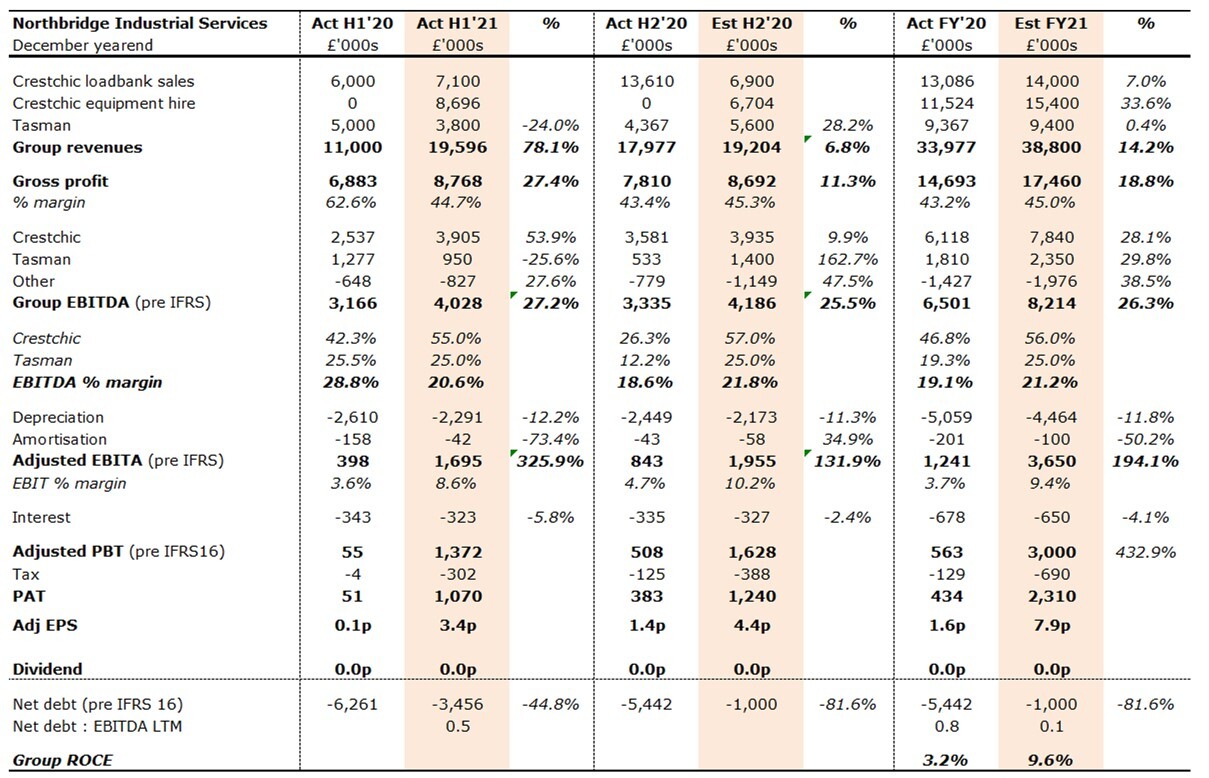

Culminating with news last Friday that FY21 adjusted PBT would be “in line” with consensus (Shore Capital at £3m) driven by a 20% rise in turnover at Crestchic to £29.4m. Adding too that the non-core Australian/NZ Tasman unit had been sold for £4.1m.

Here Crestchic’s “hire fleet revenues jumped 34% to £15.4m with sales/service up 7% to £14.0m. [In fact volumes] would have been even higher, but for capacity and supply chain constraints.”

As evidenced by another record closing orderbook – driven by ‘vibrant’ data centre demand alongside numerous tailwinds – such as renewables, geographic expansion, marine decarbonisation, new products, etc.

Indeed the pipeline is so encouraging that its Burton-on-Trent factory is expanding production by 50%, with the extra capacity set to come on-stream in Q2’22.

Sure there has been some input cost pressure due to higher commodity prices, freight rates, labour, etc. Yet equally, this has now been successfully passed-on, indicating robust pricing power. Plus despite H2 turnover falling sequentially, this was simply caused by unusual ‘pass-through’ revenues & Chinese contracts in H1’21.

Elsewhere, gross margins climbed thanks to improved mix. Whilst net debt fell to £1m vs £5.4m LY, & should soon be eliminated following the Tasman disposal.

But that’s not all. Christopher Mills’ son no less Nicholas (22.6% stake) - another superb investor in his own right - has decided to join the Board. Further enhancing an already very capable top team.

So what does this all mean?

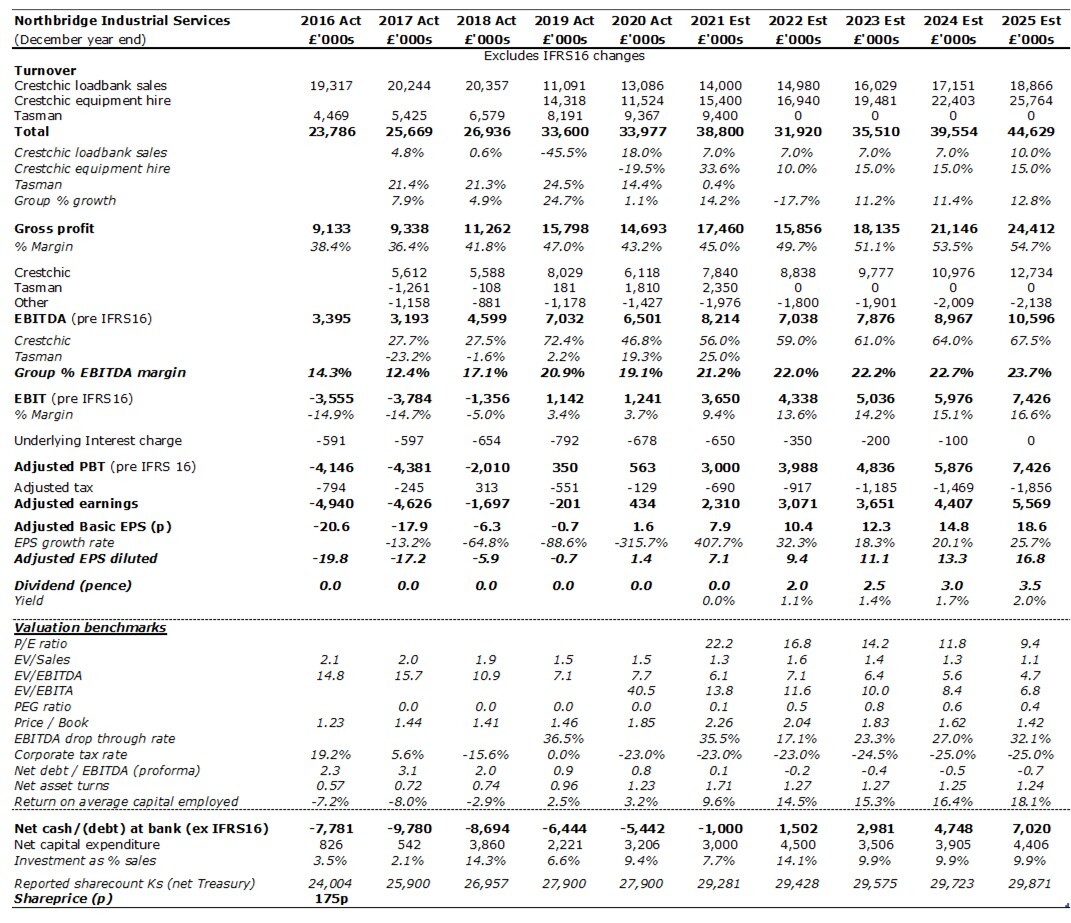

Well wrt the numbers, I’ve raised both my forecasts (FY22 EBITDA of £7.0m on revenues of £31.9m) and valuation to 244p/share vs 200p+ B4.

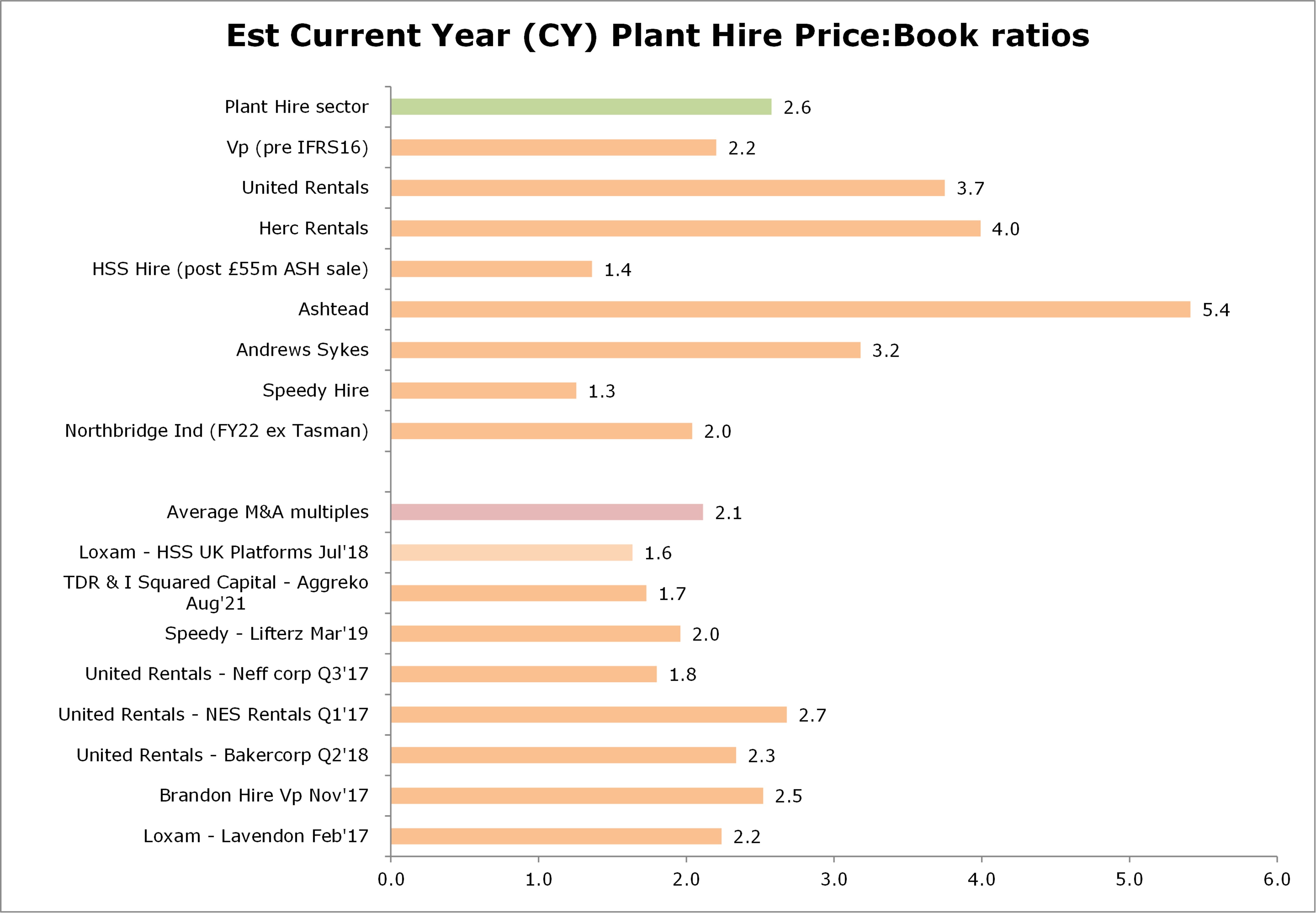

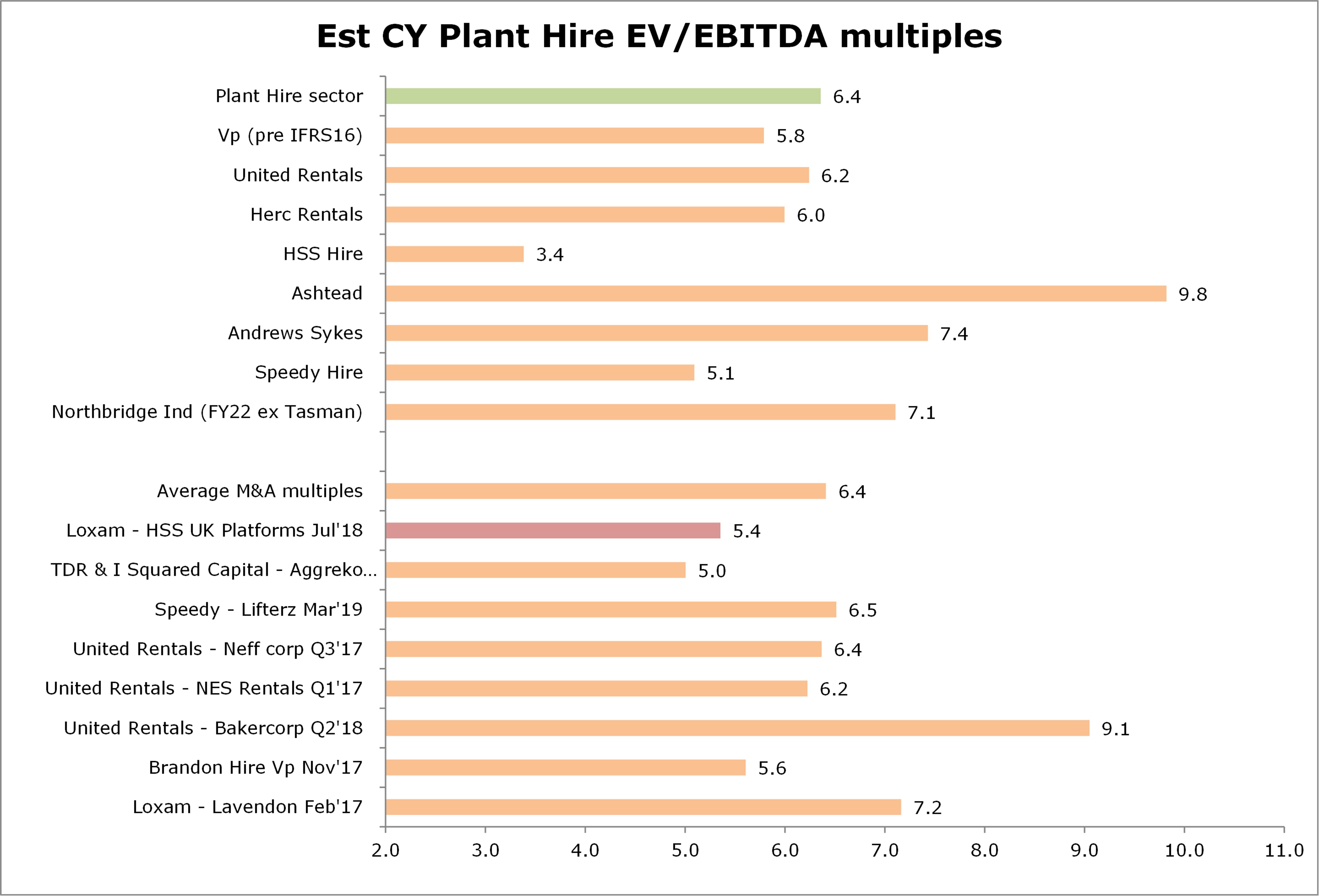

The latter based on a 10% discount rate (ie lower cost of capital), 20% ROCE by 2025 and a 10x EV/EBITDA multiple. Mirroring Crestchic’s powerful secular growth drivers and long life rental fleet (ie few/no moving parts) that require far less replacement capex than many of its plant hire peers.

Finally, watch out for further news at the upcoming Capital Markets Day (10/03) & prelims (12/04).