[source: e-Traction]

One basic rules of investing, is never to become a distressed seller.

Rock star fund manager Neil Woodford learnt this the hard way in 2019, & equally Chinese property developer Evergrande Group (EG) is under the cosh today. Swamped by >$300bn of debt, & is frantically jettisoning even its ‘crown jewels’ to the highest bidder.

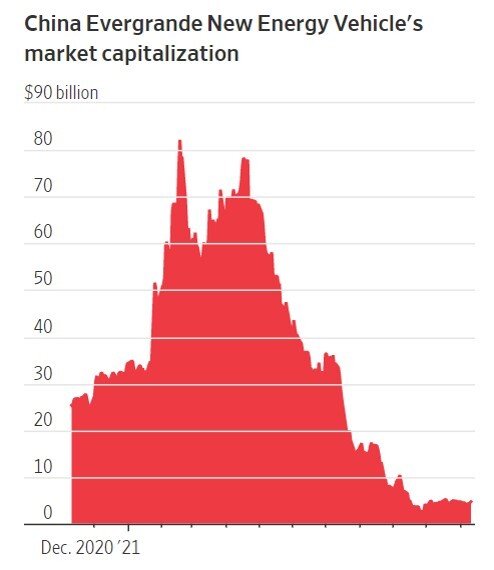

Here EG owns a 63.7% stake in Hong Kong listed ‘Evergrande New Energy Automotive (ENEA)’, which likewise has seen its shares collapse (see charts), & is allegedly struggling to pay staff.

However corporate pain can similarly provide incredible opportunity for nimble trade buyers, who already know their pray inside-out.

This morning Saietta (SED ) – a pioneering EV firm commercialising its highly efficient, light-weight & low cost/maintenance Axial Flux electric motors – said it had acquired the Netherlands based electric power train manufacturer e-Traction from ENEA for up to €2m.

To me, this looks a fabulous piece of deal-making. Not only purchasing top notch IPR (eg in-wheel tech), production and R&D capability at a knock-down price, but also accelerating its entry into HGV/commercial electric vehicles.

Indeed, e-Traction’s drive trains have already completed >2.6m in service kms since 2009, & are used by 8 commercial enterprises & 7 European OEMs.

Sure the business is loss-making currently on 2020 sales of €1.2m given the acute difficulties of its parent. Yet equally, the same unit generated revenues of €11.4m in 2019, before the property giant’s debt concerns engulfed the wider group.

CEO Wicher Kist commenting: “This acquisition will allow Saietta Electric Drive to accelerate its business plan by several years adding not just commercial and technical capability but also extending our IP portfolio and acquiring an operational power electronics production facility.”