It’s rare investors can buy high quality, fast growing life-sciences stocks at attractive prices. SourceBio International Plc (SBI) - a leading medical testing and lab services firm - is one.

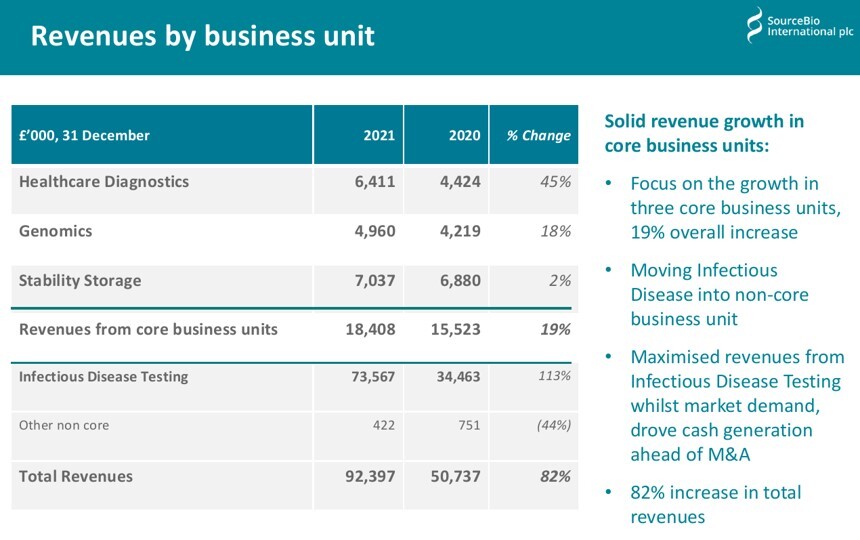

Today the company reported ‘record 2021 results’ (see charts), alongside a resurgence in its core Healthcare diagnostics (+45% to £6.4m), Genomics (+18%, £5.0m) & Stability storage (+2% £7.0m) divisions.

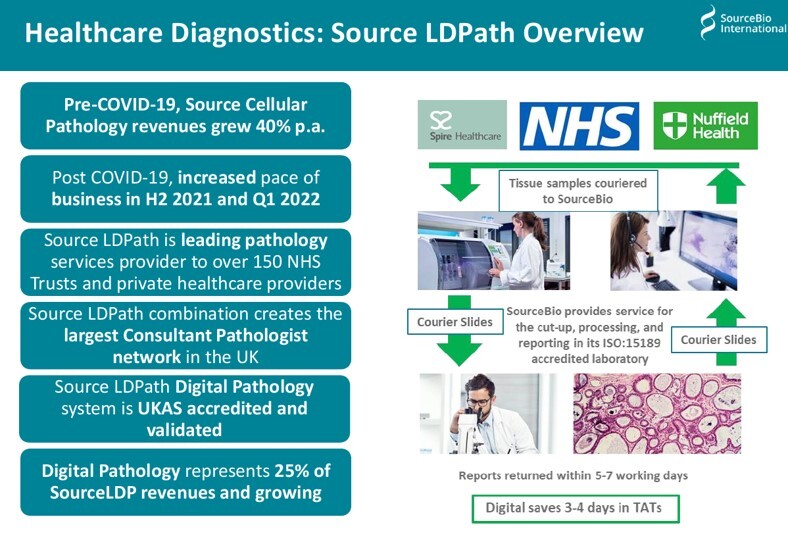

On top in March, its cellular pathology unit (eg testing tissue samples/biopsies) acquired LDPath for £18.5m (excl earnouts). Itself a rapidly expanding digital leader in this space - with the combined operation now the UK’s #1 Consultant Pathologist network.

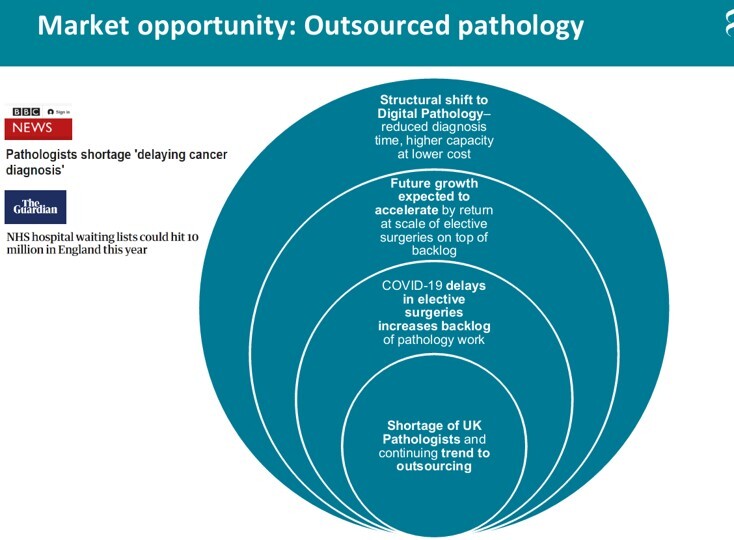

Here the NHS spends around £2.5bn pa (+10% pa) – driven by ageing demographics, lengthening waiting lists (>6.1m) & an ongoing shift towards earlier diagnoses (eg cancer screening).

Moreover, a greater proportion of this budget is being out-sourced to 3rd parties, given the NHS’ limited in-house resource & shrinking pool of pathologists. Especially to those specialists offering telemedicine, where there is not only much faster turnarounds (eg from 5-7 days to ultimately <24 hours) & higher throughput, but also substantial efficiency savings & enhanced accuracy.

Meaning altogether, I estimate these 3 divisions alone (excluding Covid PCR testing) should be able to achieve between £10m-£13m of EBITDA on turnover of £50m-£55m by 2025. Building on Liberum’s 2023 estimates of £8.7m & £39.8m respectively.

Ok, so how much is the business worth?

Well, assuming a 14x EV/EBITDA multiple, this would equate to a hypothetical valuation range of between 185p-245p/share. Offering considerable upside potential to long term investors vs 115p today – and not too dissimilar either to Liberum’s 220p target price.

Elsewhere post the LDPath deal, there’s even another £15m+ (c. 20p/share) of net cash left over - providing ample capital to further accelerate organic & acquisitive growth.

All told, a prime example of GARP investing.