Tekcapital (TEK), an intellectual property investment group, announced that its portfolio company Innovative Eyewear has licensed its smart eyewear technology to sportswear brand Reebok through an agreement with Authentic Brands Group.

"We are pleased to partner with Lucyd to pioneer Reebok's smart eyewear offering" said Steve Robaire, EVP - Reebok International at Authentic. "Reebok is known for delivering innovation across all of its product categories. Through Lucyd's Bluetooth technology, we reinforce the brand's standards in this emerging category."

The initial Reebok smart eyewear collection is expected to launch early in 2024 with styles for men and women.

This is a significant milestone for Innovative Eyewear and its disruptive smart eyewear line. Two months ago, the company integrated ChatGPT into its eyewear through a voice interface and an app. Today's announcement reaffirms the viability of the technology as a mainstream offering, as it is being embraced by a major sportwear brand. Just as smartwatches transitioned from the world of tech enthusiasts to mainstream sportswear, smart eyewear is poised to follow the same path.

Prior to today's agreement with Authentic Brands Group for Reebok, Innovative Eyewear licensed Nautica, a major lifestyle brand, for its smart eyewear technology in October 2022. The two major licensing deals follow Innovative Eyewear's floatation on NASDAQ last summer, which raised US$7.3m. Tekcapital, 67%-owner, sees a US$29bn market opportunity, with safety glasses alone representing over US$1bn. Innovative Eyewear plans to expand its offering across all four segments of the eyewear market: ready-to-wear sunglasses, prescription eyeglasses, safety glasses, and sport glasses.

Tekcapital shares rose 3.9% on today's news.

We see Tekcapital as significantly undervalued at the moment. Tekcapital's NAV per share was adjusted to US$0.38 (31p) at the end of FY22 while its current share price is 13.5p. There is significant potential for growth therefore, with MicroSalt's upcoming IPO a possible value inflection point for the company.

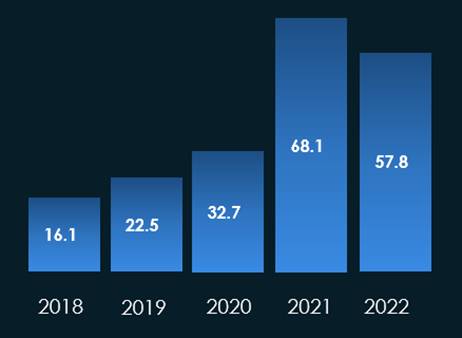

The overall trend for Tekcapital's portfolio is up, with steady increases in valuation each year since initial investment in 2018 (see chart below). From a technical standpoint, some consolidation was expected at this point, and the wide discount to NAV offers an attractive entry point.

Tekcapital historical net assets (US$m)

Follow News & Updates from Tekcapital: