By Kathleen Brooks, research director at XTB.com

The BOE maintained rates today at 5.25%, which was widely expected by the market. However, the monetary policy summary from today’s meeting was interesting. The key section was at the end: ‘As part of the August forecast round, members of the Committee will consider all of the information available and how this affects the assessment that risks from inflation persistence are receding.’ This sounds like there are several MPC members ready to cut rates and that there is a decent chance that if we see wage growth and service prices recede in the next month, then an August rate cut is possible.

Can the doves persuade more members to join them?

The vote split at today’s meeting was 7-2. With Dhingra and Ramsden voting for a cut and the other 7 members voting to hold rates steady. The minutes of the June meeting said that there was a range of views regarding the risks of inflation persistence. Some members believe that inflation risks could turn to the downside as quickly as they turned to the upside. However, other members worry that there has been a structural shift in wage-setting behavior which could keep upward pressure on service price inflation in the long term. The Committee also noted that the higher frequency measures of service price inflation had picked up in the three months to May. Thus, those who are urging caution when it comes to rate cuts have the evidence to back it up.

However, the Minutes also noted that for some members the decision to hold rates steady was finely balanced as they noted that the disinflation trend was continuing even with stubbornly high wages and service prices. These members are willing to look through high pay growth and high levels of service price inflation and they are more worried about the outlook for growth. Dhingra and Ramsden, the two doves at the BOE, need to bring three more members onto their side to get a narrow majority to agree to a rate cut in August. Since some members are said to be finely balanced about whether to hike or cut rates, the prospect of them getting the numbers to push through a rate cut in August seems possible.

The market rushes to price in an August cut

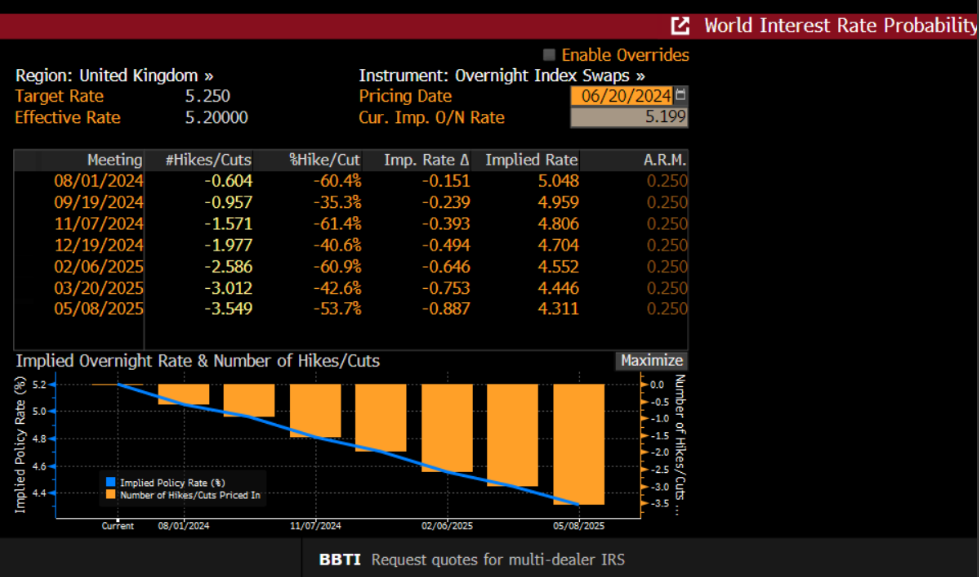

The market reaction has been swift. The market has taken today’s news as a step in the direction of a rate cut at the next BOE meeting. The market is now pricing in a 60% chance of a rate cut in August, up from a 35% chance before the meeting, according to the swaps market. 2-year UK Gilt yields are down nearly 9 basis points, and the pound is lower vs. the USD. The market can bask in its hopes for a rate cut, as MPC members will now enter a quiet period until after the election, so they won’t have any members pouring cold water on their hopes for a rate cut in 6 weeks.

To conclude…

To sum up, the BOE’s statement and minutes have kept ajar the door for an August rate cut, as they have acknowledged the progress made on inflation to reach the 2% target. Although they remain committed to inflation returning sustainably to the 2% target rate, they did give some decent excuses for the elevated levels of service price inflation, including prices that are set annually and other indicators that suggest wage growth could ease in the coming months. The market is taking this as a dovish sign, and are increasing their bets for an August rate cut.

Chart 1: UK interest rate probabilities, measured by the Overnight Index Swaps market.

Source: XTB and Bloomberg

XTB CY-RISK DECLARATION: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB UK-RISK DECLARATION: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with XTB Limited UK. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB is a trademark of XTB Group. XTB Group includes but is not limited to following entities:

X-Trade Brokers DM SA is authorised and regulated by the Komisja Nadzoru Finansowego (KNF) in Poland

XTB Limited (UK) is authorised and regulated by the Financial Conduct Authority in United Kingdom (License No. FRN 522157)

XTB Limited (CY) is authorized and regulated by the Cyprus Securities and Exchange Commission in Cyprus. (License No.169/12)

Clients who opened an account from the 1st of January 2021 and are not residing in the UK, are clients of XTB Limited CY.