Turn the clock back 2 years, & the UK was in total lockdown. GDP plummeted >20% & the government doled out 100s of £bns in financial aid that propped up both good & bad businesses.

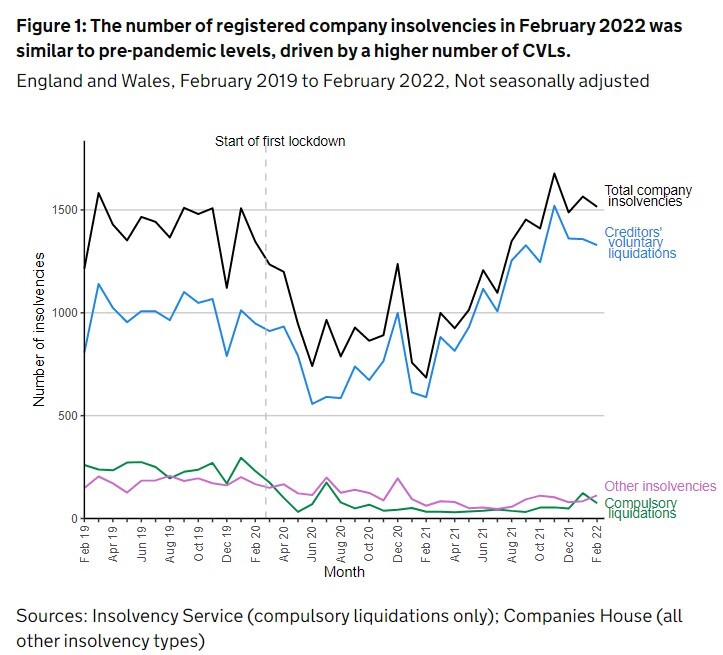

Even resorting to to a series of creditor protection measures that have only just been lifted - artificially suppressing UK insolvencies (see chart).

However this unprecedented support has created a substantial backlog of cases – ie not too dissimilar to patient waiting lists & elective surgeries. Especially for those poorly financed ‘Zombie’ firms that would have gone bust anyway, but have instead been allowed to limp along through the pandemic.

In addition, many other ‘marginal’ firms now also face a ‘perfect storm’ of higher inflation, HMRC loan repayments, tougher bank lending, rising bond yields & consumer belt tightening.

Meaning that for the insolvency industry, conditions are getting much busier. In fact this would probably have happened earlier, if it hadn’t been for Omicron disrupting the full return to offices & courts over the past 4 months.

Not surprisingly this temporary delay impacted MANOLETE’s Q4’22 results. With the UK's largest 3rd party 'Insolvency Litigation Funder', saying today that FY22 EBIT (y/e March) would be in the range of £5m-£6m vs consensus at £7.5m.

Equally though, cash collections were robust - which together with the settlement of a large one-off £9.5m case in April – should soon reduce net debt to £6.5m vs £10.3m in Sept’21.

More importantly FY23 has started strongly, with CEO Steven Cooklin adding: “An insolvency ‘catch up’ [is expected] over the next year & beyond, which will provide MANOLETE with significantly increased opportunities. New case enquiries have rebounded sharply in the last 4 weeks, as IPs and lawyers returned to more normal working conditions. [We are] in good shape going into FY23.”

Ok so how much is the stock worth?

Well broadly I estimate MANO should be able to deliver £13m-£15m of EBIT by FY25. Which on a 13x-15x multiple would generate a theoretical price of 380p-500p/share vs 235p today. Offering plenty of upside for long term investors, alongside a Sept’21 NTAV of 93p/share.