Come rain or shine, Avingtrans (AVG) continues to deliver, with the shares rising having risen at a compound annual growth rate of over 20% over the past 13 years. That's been driven by consistent execution of its value-creating “Pinpoint, Invest & Exit” (PIE) strategy, and its laser-like focus on supplying niche and often mission-critical safety products and services to regulated industries under extremely harsh conditions.

That leaves Avingtrans as a durable growth business with more than £16m of net cash - around 50p a share - good forward visibility and robust pricing power, attributes that should help it withstand even the toughest of economic climates.

This rare combination of quality growth and downside resilience is evident once again today in its latest trading update, in which it said that results for its financial year to May 2022 would be in line with market expectations.

House broker Singer Capital Markets has pencilled in adjusted pre-IFRS EBITDA of £11.4m and EPS of 21.2p this year on sales of £100.9m – climbing to £12.5m and 24.1p on revenues 8.9% higher at £109.9m in FY 2023.

Better still, the order book and prospects pipelines “remain strong”, further bolstered by “Hayward Tyler securing a $1.1m contract extension for the ongoing development of next generation molten salt pumps, under the Advanced Reactor Demonstration Program”.

In light of the Ukraine conflict and subsequent energy crisis, and a renewed focus on nuclear as potential solution energy needs, I understand this sector alone now accounts for more than 40% of Avingtans’s backlog, including decommissioning, lifespan extension and next-generation technology projects.

Similarly, its healthcare interests are flourishing too, with partner Adaptix Ltd - in which it owns an 11.9% stake - recently filing for 510(k) premarket notification with the FDA. If approved, that would allow it to begin marketing its ground breaking, Point-of-Care (PoC) 3D orthopedic system in the US.

Adaptix Ltd has developed novel technologies that allow affordable, low-dose 3D imaging using Digital Tomosynthesis, to provide quicker, more accurate diagnosis. This is a significant milestone for Adaptix Ltd and trailblazes the path for Magnetica Limited - in which Avingtrans holds a 58.1% stake - which is commercialising its own first-of its-kind small form MRI scanner.

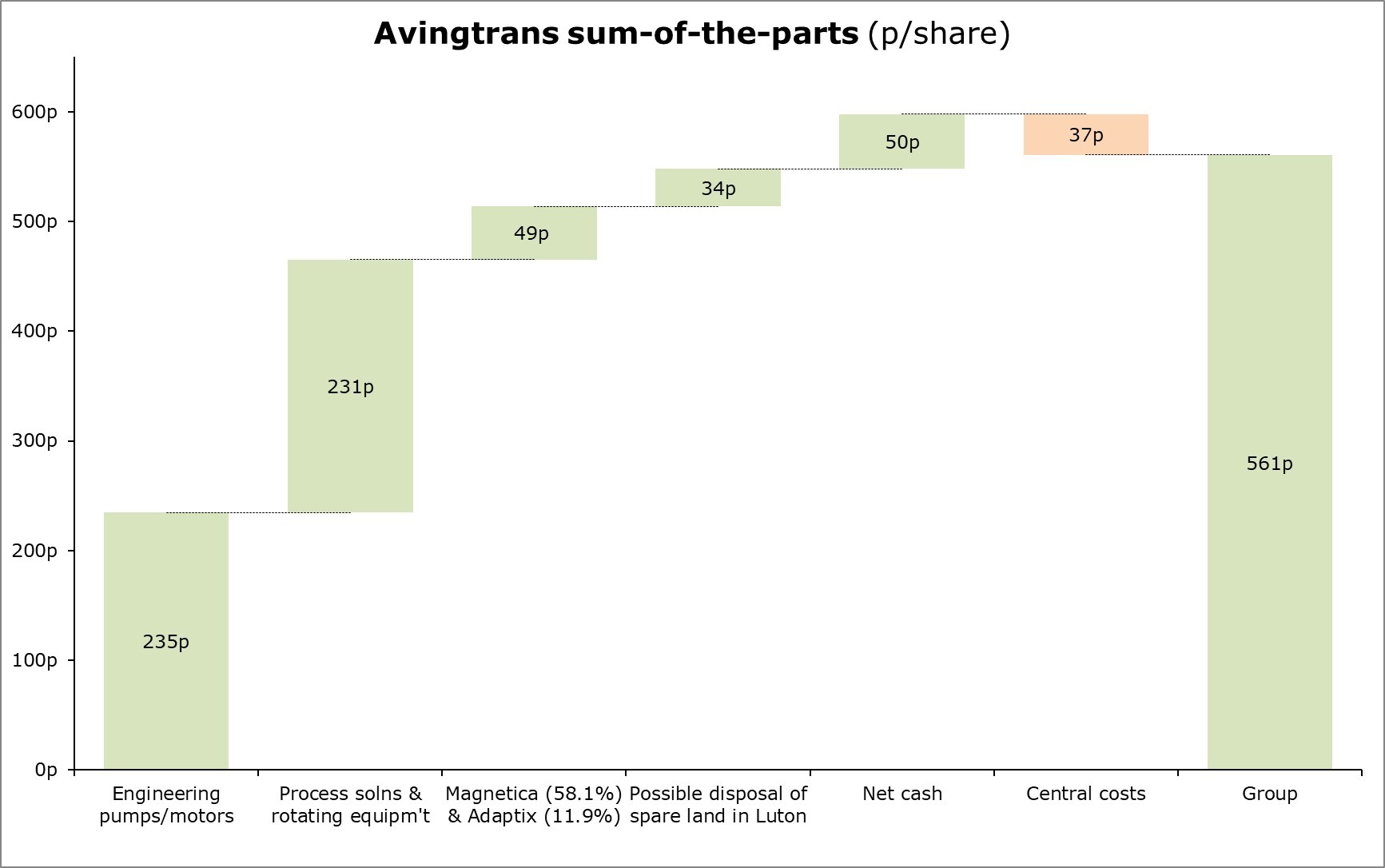

Brokers Singer Capital Markets and finnCap value Avingtrans' shares at 510p and 495p, respectively. I think they look conservative - my ‘sum-of-the-parts’ valuation comes out at 561p a share, reflecting attractive, regulation driven markets, alongside several large, multi-year deals including the provision of ultra-secure storage boxes to Sellafield (through subsidiary Metalcraft) and blast proof doors to HS2 (through Booth Industries).

CEO Steve McQuillan, commented: “We are very pleased with the performance, overcoming many challenges & working tirelessly to report FY'22 results in line with market expectations. #AVG has entered the new financial year with continued momentum, with strategic progress continuing and a robust pipeline of opportunities setting the foundations for solid growth for FY'23”.

Preliminary results are scheduled for 28th September 2022.