I appreciate this may seem a little premature, but after falling more than 50% from its 12-month high of 404p, I’ll stick my neck out and say shares in Cake Box (CBOX ) - the UK’s ‘go to provider’ of luxury yet affordable, fresh cream cakes - have turned a corner.

Sure, the consumer is retrenching in the face of a painful cost of living crisis. Yet equally, I believe people will continue to buy affordable treats, particularly those that have an important role to play at family occasions. Indeed, my own daughter is no different, having already requested a Cake Box fresh cream cake for her party in August.

Anecdotal evidence, aside the business isn't doing badly either. Despite the more challenging environment, it yesterday released frankly blockbuster FY22 numbers. Adjusted pre-tax profit and EPS came in at £7.0m (+49% LY) & 13.8p (+44%) respectively, on sales 50% higher at £33m, alongside an increase in net cash to £5.2m, or 13p/share.

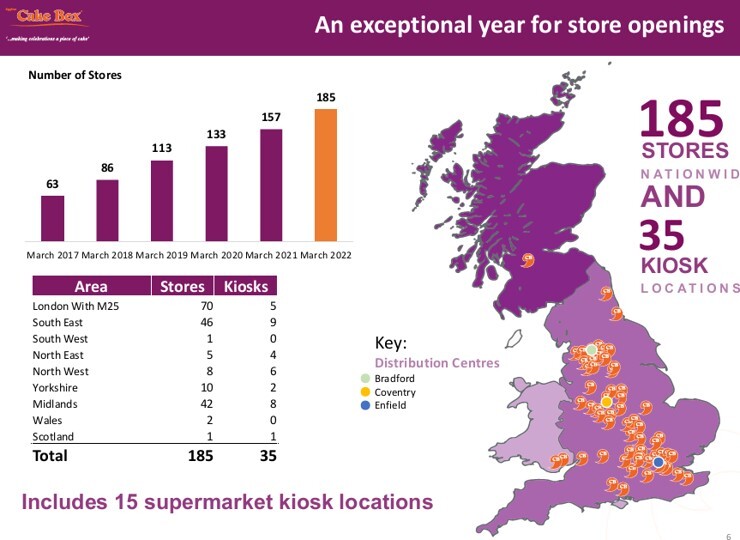

That reflects 12% like-for-like franchisee system growth to £66m, 28 net new store openings (taking the total to 185 as at March 22), digital sales up 41% to £13.3m (20% of total), and the ongoing roll out of kiosks at shopping centres (20 in total) and Asda supermarkets (15).

Granted, the like-for-like revenue growth rate may have started to soften, which house broker Shore Capital describes as “slightly down YTD vs tough comparatives” . The slowdown has probably been exacerbated, too, by more people taking more overseas holidays and the Queens’ Jubilee.

Nonetheless, 24 new franchised sites (re 54 deposits) are planned for this year, with Shore Capital forecasting FY23 sales growth of 6.3% to £35.1m, PBT to climb 2.9% to £7.2m, and EPS to increase 3.6% to 14.3p on the back of continued UK expansion, investments in headcount, system capability and internal controls.

That should mean the group is on track to hit its 2-3 year target of a 250 store footprint, with turnover split evenly across both online and bricks-and-mortar channels.

Elsewhere, input cost pressures are being managed well, and managament has plenty of other levers to pull should the economic climate deteriorate considerably.

So putting all this together, I would conservatively value this capital-lite company on a 12x forward EV/EBITDA multiple (FY23: £8.1m), equivalent to over 250p/share.

CEO Sukh Chamdal commented: "Despite a challenging economic and trading environment, we have delivered yet another strong set of results and continue to trade robustly post period end. The Cake Box Family is bigger and more geographically diverse than ever before, and we are serving more customers than ever, with a keen focus on value for money.”