The planets are aligning for Equals (EQLS ), a leading, B2B international e-payments and fintech platform.

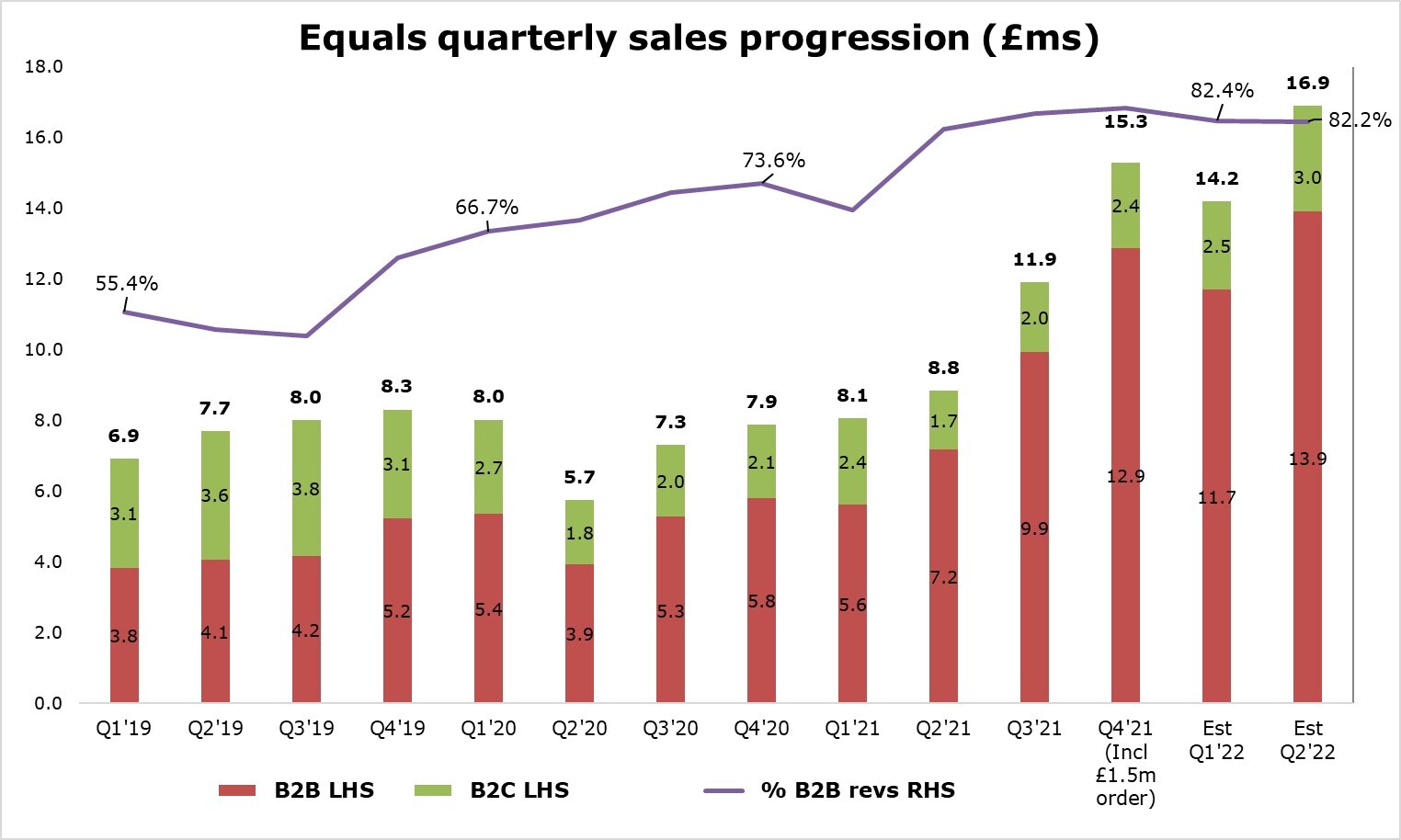

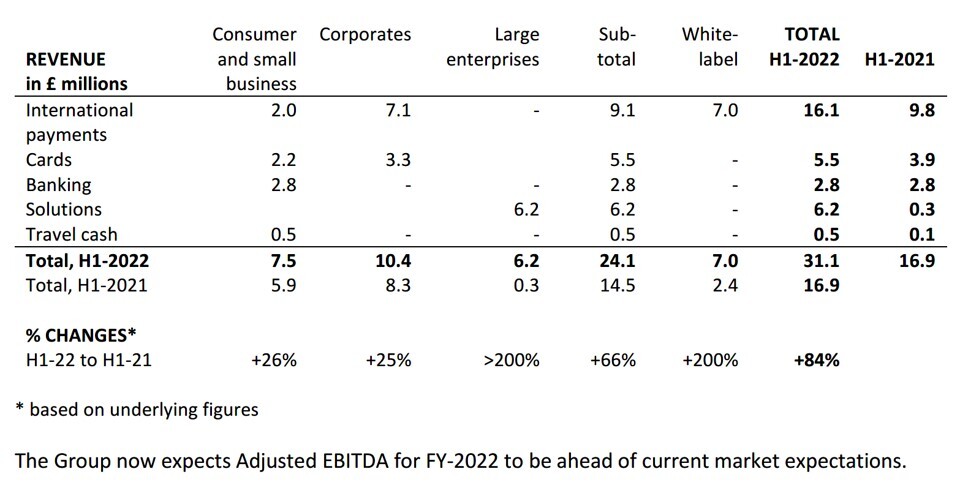

This morning the firm posted a “record breaking” H1 22, with like-for-like revenues soaring 84% to £31.1m from £16.9m last year, with second quarter revenues similarly climbing 19% sequentially to £16.9m from £14.2m in a year earlier.

So, what’s driving this rapid growth?

Well, after assembling a suite of ‘best-in-class’ applications, both new and existing customers alongside white label partners are now using the services in their droves. Sales per day are motoring ahead, up 87% to £252k in H1 22 from an average of £136k last year, and by my estimate likely to have been closer to £270k in the second quarter.

Assuming this pace is maintained for the rest of FY 22 , that would theoretically deliver another £33.2m of turnover in H2, or £64.3m for the year. And that’s excluding any further acceleration or boost from overseas travel, as the school holiday season kicks off in earnest.

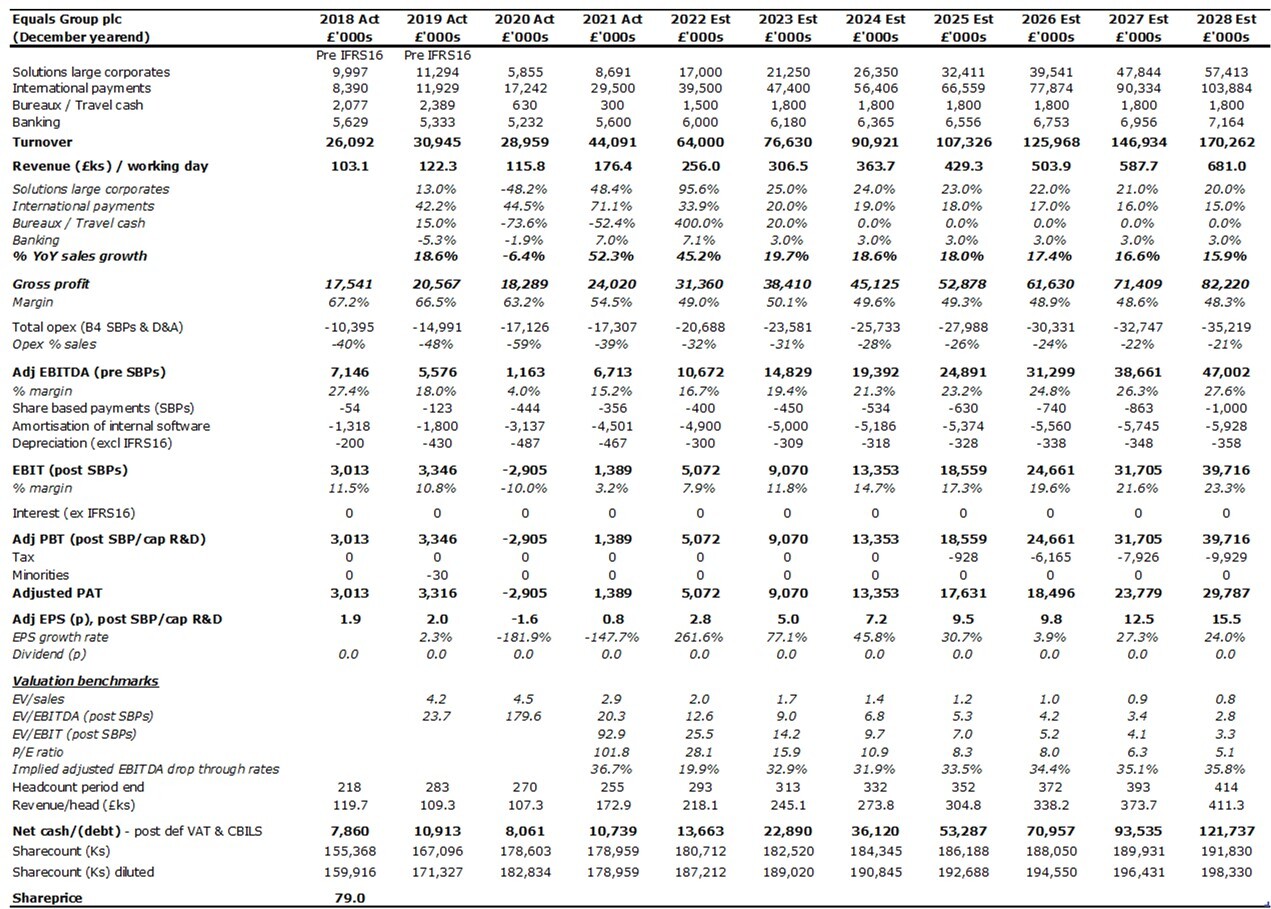

Consequently, I’ve upgraded my FY 22 turnover and adjusted EBITDA forecasts to £64.0m (from £62m previously) and £10.7m (from £9.7m), respectively, rising to £76.6m and £14.8m 12 months later (see chart).

That in turn lifts the valuation from 138p to 152p a share - equating to a FY 23 EV/sales ratio of 3.4x - and offering more than 90% potential upside from the current 79p share price. That frankly looks far too low to me given the turbo-charged growth being delivered, and in comparison to peers - the stock trades on a 2022 EV/sales ratio of 2.0x compared to 3.9x for the broader payments space and 6.3x for nearest rival Alpha FX.

Elsewhere, I believe aggregate gross margins are normalising within the 48%-50% range, or 59% excluding white label sales - although this is, of course, dependent on the future divisional mix. And strong cash generation, and a balance of £15.1m, is likewise powering organic investments in product development, marketing, front-office staff and compliance capabilities (around £1.6m a year).

CEO Ian Strafford-Taylor commented: “We are extremely pleased to see an 84% increase in our revenues in H1 22 with all segments performing exceptionally well. We believe that our revenues are highly ‘inflation-resistant’ and that this should be beneficial for the Group in H2 22 and beyond.”

Lastly, watch out for what I expect will be more positive news at the interims on Wednesday 7th September.