One hallmark of great companies is that they don't allow temporary external factors to derail their strategic ambitions.

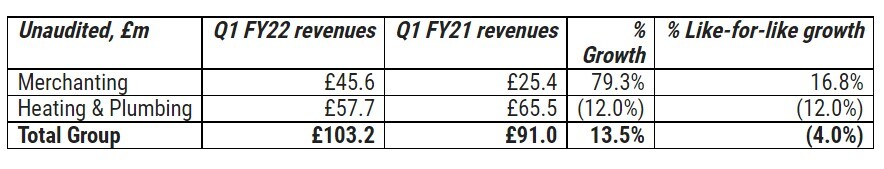

Similarly Lords Group Trading – a specialist UK building merchants & heating/plumbing distributor - said today that despite being impacted in Q1’22 by industry-wide boiler supply constraints (re component shortages at OEMs eg pumps), leading to a -12% fall in LFL H&P sales (see chart) .

The group as a whole was still ”largely” on track to hit FY’22 consensus expectations (source Cenkos) of £438m revenues (vs £363m LY), £26.7m adjusted EBITDA, PBT £16.0m & 7.7p EPS (5.4p). Thanks to improved product mix (re +16.8% LFL growth at the higher margin BM division), well integrated acquisitions & self-help measures (eg cost control, pricing, etc).

This is a credit to LORD’s entrepreneurial management, & a reflection of the underlying resilience of the business. With demand remaining “strong” right across the board, & boiler supply issues set to “ease” later this year.

CEO Shanker Patel commenting: "We continue to make strategic acquisitions that are integrating well & adding to our size, reach & product range, which helps to better serve our customers and ultimately drive growth.

While industry wide boiler component shortages have created a short-term impact on our Heating & Plumbing division, importantly customer demand remains robust, showing the strength of our proposition."

With regards to valuation, Cenkos reiterate their BUY rating adding: “We would be buying into any price weakness in the belief that Lords is still very capable of delivering superior organic growth & acquisition enhancement in the medium-longer term.”

Hence at 91p, the stock trades on modest CY EV/EBITDA & PE multiples of 7.0x and 11.8x. Whereas personally, I would value the firm on a 15x FY’23 PER, equivalent to c.131p/share.

Elsewhere, the UK residential property market continues to go from strength to strength, with house prices rising 9.9% YoY in April according to Rightmove.

Sure this might cool off later in this year as mortgage rates climb & inflation bites into consumers’ wallets.

Yet equally, the RMI sector (80% of LORD’s turnover) remains robust driven by the need to upgrade ageing properties (re decarbonisation) & the shift towards premiumisation (ie nicer homes), alongside the government’s pledge to construct 300,000 new properties annually (vs c. 200k today), ‘Build to Rent’, recladding & greater infrastructure spend (eg HS2, nuclear).

Meaning all-in-all, #LORDs looks to be a classic case of "don’t throw the baby out with the bath water". Final 2021 results are scheduled for Tuesday 24 May.