Are investors talking themselves into a recession? I suspect so.

In fact, take the UK building products industry as a prime example.

Here after the widespread equity sell-off, the sector valued on less than 10x PER, representing an unwarranted 30%+ discount to long-term averages. In essence, implying that future earnings will drop off a cliff.

Sure growth might moderate, yet equally I believe profits are unlikely to fall anywhere near as far as valuations have already priced in.

Just look at today’s positive 1H22 results from UK builders' merchant & plumbing/heating distributor Lords Group Trading LORD

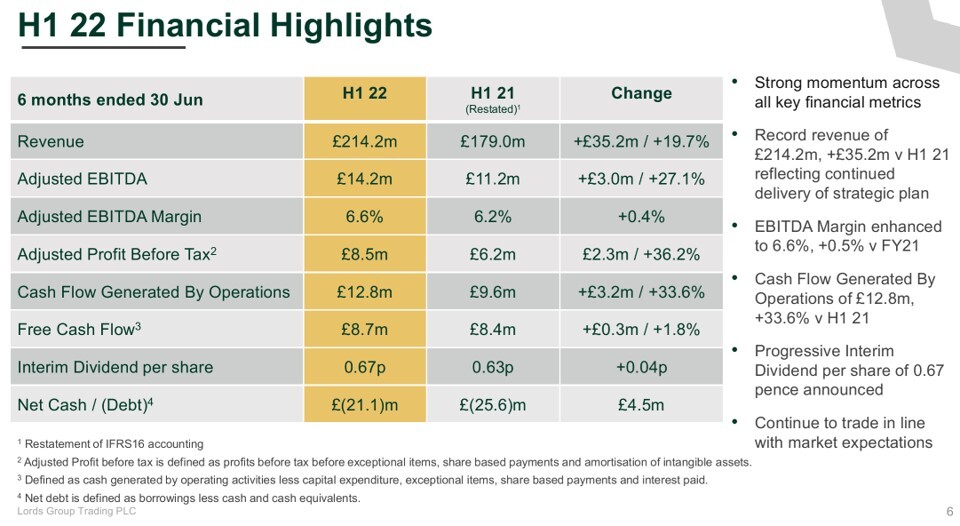

Posting record turnover up +19.7% to £214.2m, adjusted EBITDA of £14.2m (+27%) & PBT 36% higher at £8.5m - thanks to strong underlying demand, synergistic M&A and improved product mix.

What’s more, momentum has been maintained into Q3, underpinned by #LORD’s approx. 80% exposure to the more resilient RMI & professional markets, where millions of UK properties need modernisation.

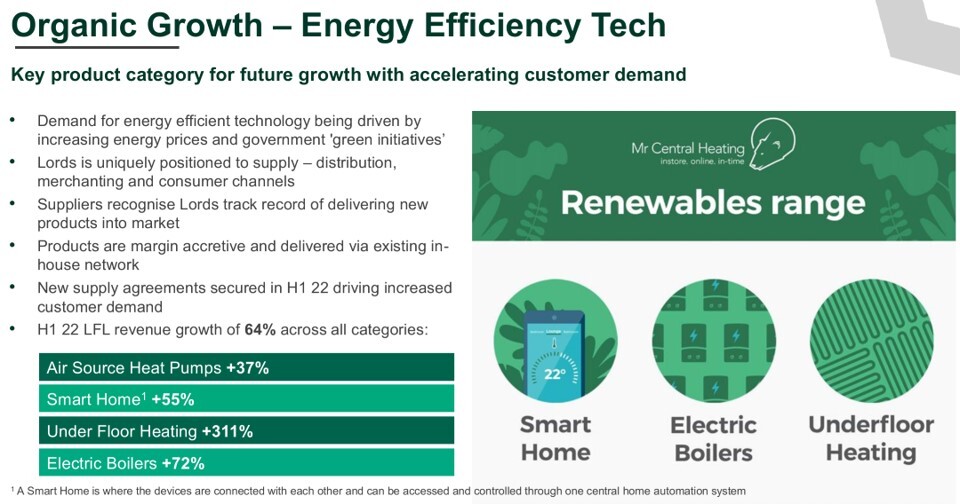

Elsewhere, Lords continues to win new customers, alongside up-selling to existing accounts as it opens additional sites, expands online and enhances its energy efficiency / decarbonisation product range (eg air source heat pumps, electric boilers, etc).

Outlook

So, with boiler supply issues set to ease, the company remains firmly on track to meet FY’22 expectations for revenue, adjusted EBITDA, PBT & EPS of £435.0m, £26.0m, £16.0m & 7.26p respectively.

Moreover – assuming a full 12-month contribution from recent acquisitions – Our analysis of annualised sales and adjusted EBITDA are already running at around £450m & £27.5m.

View from Vox

All told, providing a potential attractive entry point for long term GARP investors – with the stock trading on (at 70p) forward PE & PEG multiples of 9.6x & 0.5x, whilst also paying a 3.4% dividend yield.

CEO Shanker Patel commenting: "We have a substantial opportunity to grow the Group’s <1% market share… and reaffirm delivery of our strategic targets of £500m revenue by 2024 and 7.5% EBITDA margin in the medium term.”

Lastly, net debt (ex IFRS 16) closed Jun’22 at £21.1m - equivalent to 1.1x EBITDA - with house broker Berenberg estimating 70% upside vs its 120p/share target price.

Indeed, just think what #LORD might be able to achieve once all the supply chain challenges have been fixed!