[source: Lords Group Trading]

Investors appear to be ‘running scared’ – convinced that a deep recession is coming due to rising interest rates & the cost of living crisis. However at the coalface, many sectors are still experiencing buoyant demand. Not least the UK construction industry, where orderbooks & pipelines are full.

Sure an economic hard-landing might eventually occur. Yet today unemployment is at multi-decade lows, & the UK residential property market remains strong, with May house prices climbing 10% YoY according to Rightmove.

Plus many people have embraced hybrid working & now spend far more time at home, boosting demand for bigger properties with gardens. Yes, the Construction Products Association reckons future growth will moderate from record levels. But certainly not fall back into a deep contraction, as the equity markets seem to assume.

Ok, so what does this all mean?

Well to me, it presents a potential ‘buying opportunity’ for long term investors. Especially in those ‘best-in-class’ firms winning market share & run by entrepreneurial management teams who are executing to plan.

Here Lords Group Trading (LORD ) - a specialist UK builders merchant & heating/plumbing products distributor – ticks all the right boxes.

Today posting record 2021 results (Re sales up +18% LFL to £363m, adj EBITDA +40% £22.3m & 27% ROCE) whilst reiterating its ‘in line’ guidance for 2022, despite being impacted by temporary boiler supply issues from OEMs (re component shortages).

What’s more, after completing 4 bolt-on acquisitions YTD, the group’s annualised (ie proforma) turnover & EBITDA run-rate is now around £460m & £29m respectively. Thus underpinning Cenkos' FY’22 estimates of £438m & £26.7m, with net bank debt forecast to close Dec’22 at a comfortable £21.6m, or <1.3x EBITDA.

Elsewhere, RMI activity (80% of LORD’s turnover) remains robust underpinned by the need to upgrade ageing properties, decarbonisation & the shift towards premiumisation (ie nicer homes), alongside the government’s pledge to construct 300,000 new properties annually (vs c. 200k today), ‘Build to Rent’, recladding & greater infrastructure/warehousing spend (eg HS2, nuclear, etc).

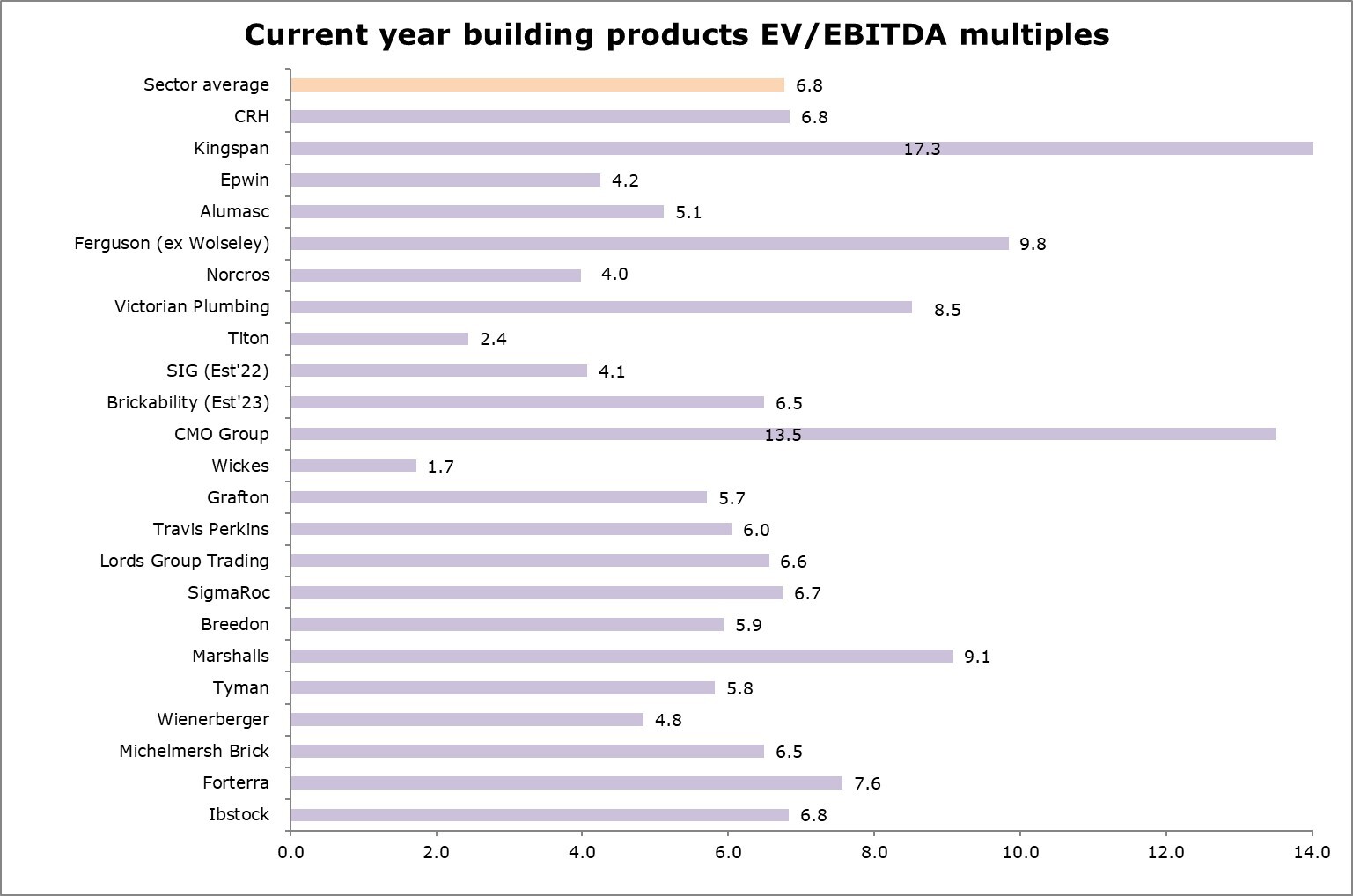

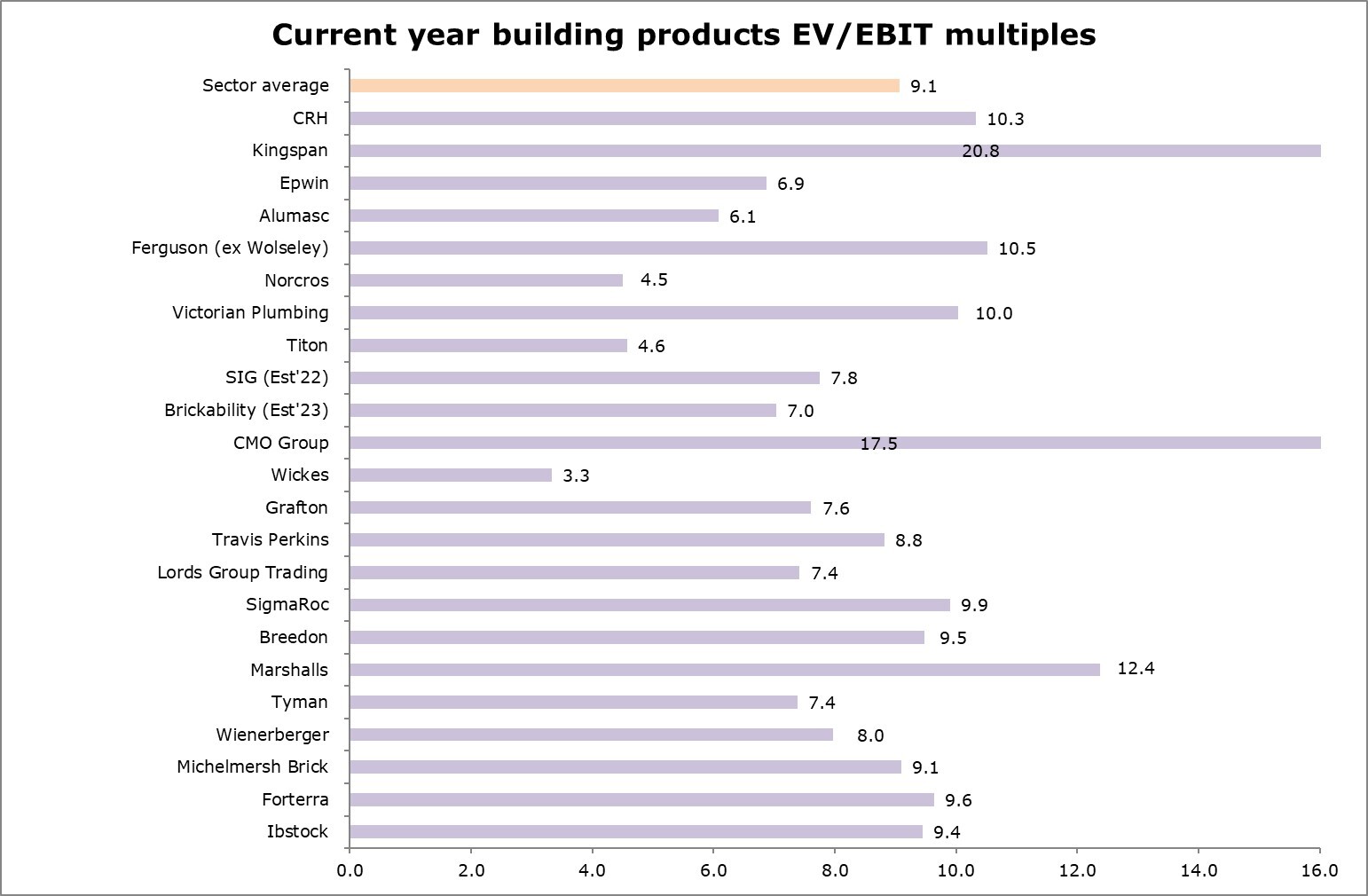

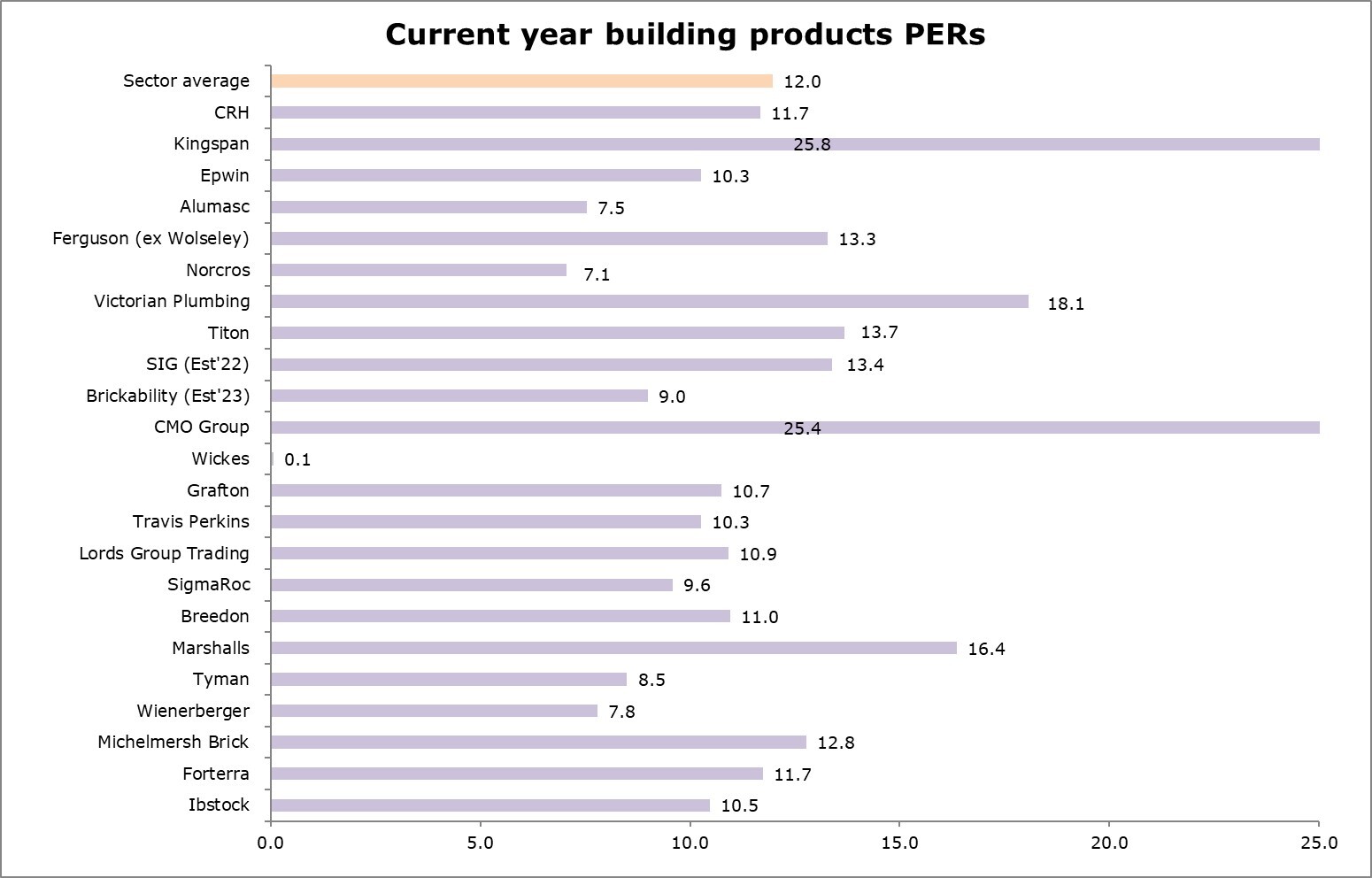

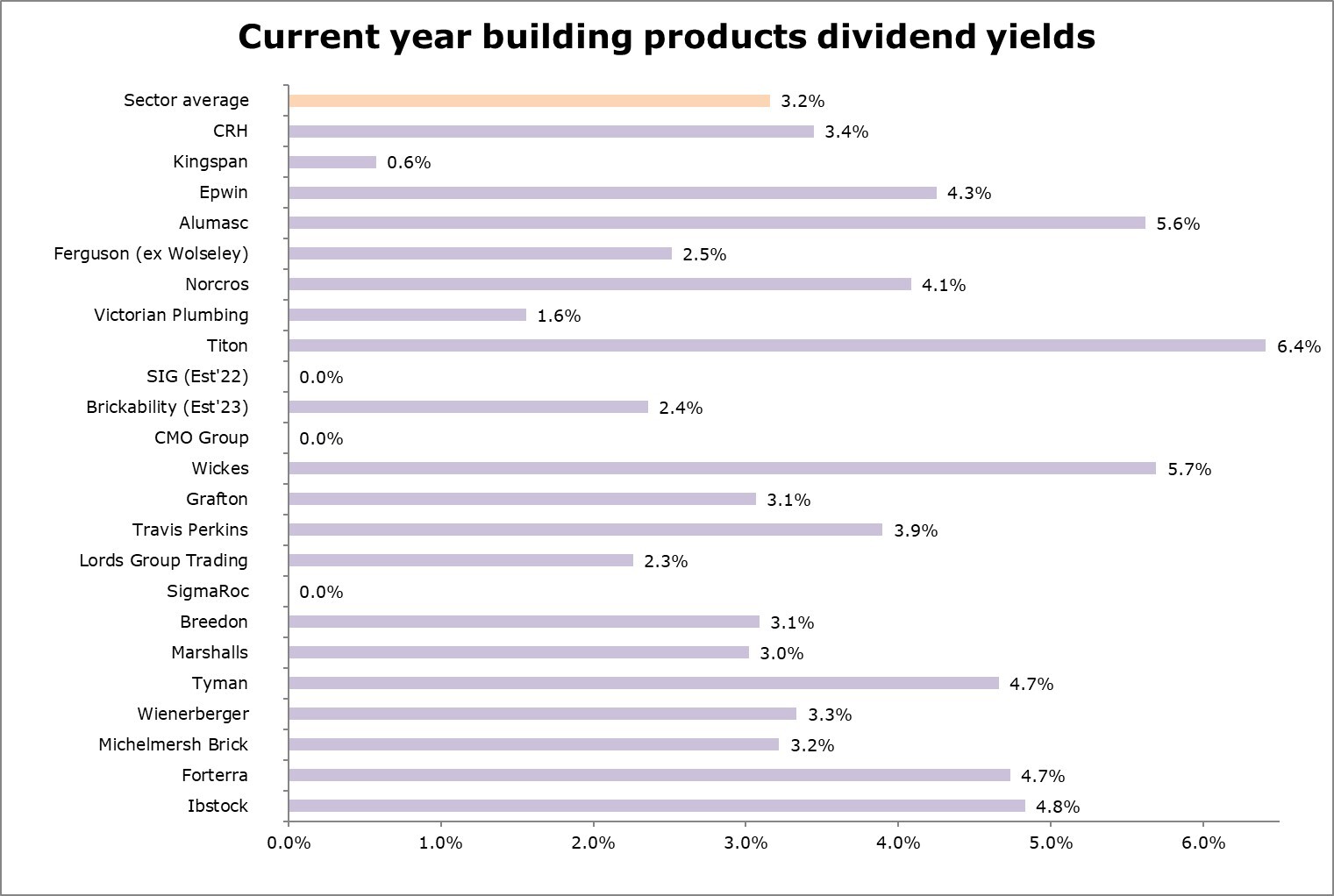

With regards to valuation, the shares at 84p trade on modest CY EV/EBITDA & PE multiples of 6.3x and 10.9x. Whereas personally, I would value the stock on a 15x FY’23 PER, equivalent to 130p/share.

CEO Shanker Patel commenting “Progress in the new financial year has continued to be strong, our 4 new value accretive acquisitions are performing in line with our expectations and we look forward with confidence as we aim to deliver sustainable and growing returns to our shareholders.”