Apparently “there’s no such thing as a free lunch”. Or that’s what I thought before the Government introduced its controversial £46.6bn Bounce Back Loan Scheme (BBLS) at the height of the pandemic to provide emergency relief for small businesses (SMEs).

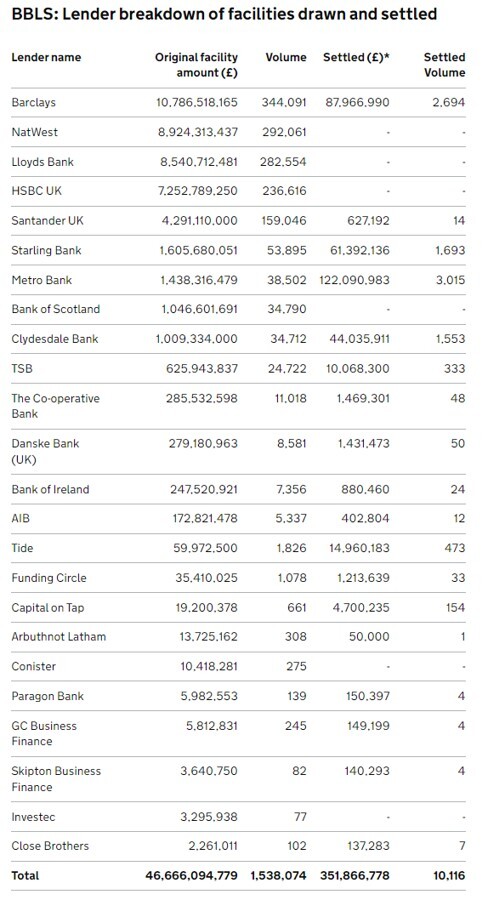

Indeed, the terms seemed almost too good to be true, encouraging more than 1.5m SMEs to apply for these interest-free, 1-year state backed loans of up to £50k. These were administered by 24 banks (see chart) with minimal credit checks.

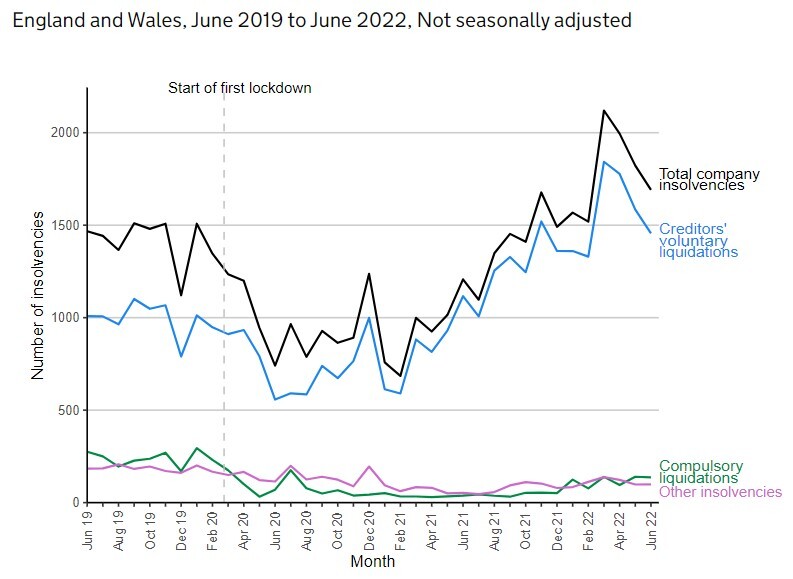

Two years on the problem now is recovering the debt, as consumers tighten their belts in response to rising interest rates, soaring inflation and recessionary fears. Worst still, given the lax eligibility criteria, officials have estimated there might also be £4.9bn of losses due to fraud or error, with around 18,000 BBLS cases already identified as "suspected frauds".

Clearly, neither HM Revenue and Customs nor the lenders want to pick up the tab. So what can be done? Well one possible solution is to use specialist insolvency litigation firms like UK market leader Manolete Partners (MANO) , which is already seeing a pickup in demand. Manolete is an expert at recovering this type of money, especially where there may have been director malfeasance and inappropriate behaviour.

So how much is the stock worth? In light of the UK’s backlog of Covid-related insolvency cases, underlying growth in the third-party recovery market and tougher economic conditions, I reckon the company should be able to deliver £13m-£15m of EBIT by FY25.

On a 13x-15x multiple, that would generate a theoretical price of 380p-500p a share against the current share price of 280p, further supported by 96p a share of NTAV. My view is that Manolete provides investors with significant counter-cyclical exposure, underpinned by balance sheet strength, as part of a diversified portfolio. Time to be patient.