CLICK HERE TO SEE VOX'S INTERVIEW WITH MANOLETE CEO STEVEN COOKLIN

The media loves a crisis, the latest one being the ‘cost of living’ and how this might impact GDP. In fact according to Google, ‘recession’ is currently searched more often than during the 2008-9 banking collapse, while economists are increasingly convinced a serious slowdown is on the way.

So in the event of a much tougher economic climate, how can investors best protect their portfolios? One counter-cyclical and attractively priced stock to consider is Manolete Partners (MANO), the UK's number one insolvency litigation specialist. Indeed after being temporarily affected by the pandemic, activity levels are now rebounding strongly as a result of:

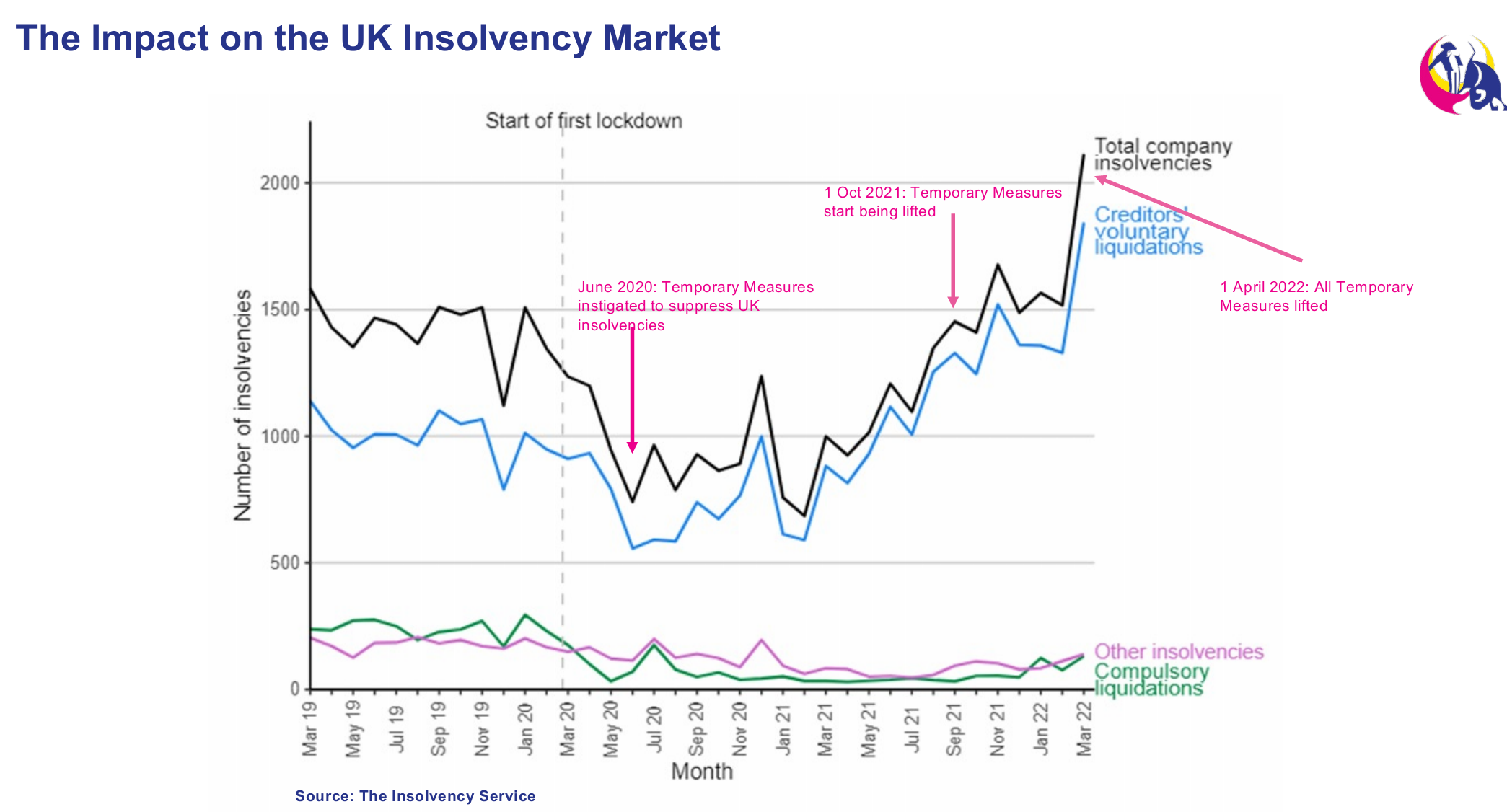

1) A rise in corporate bankruptcies (see chart), which is boosting the number cases that MANO signs up from insolvency practitioners (IPs).

2) A substantial backlog of deferred insolvencies that was built up during the pandemic whilst the government’s creditor protection measures were in force between June 2020 and March 2022.

3) A long-term shift by IPs post the 2015 Walton review to sell cases to 3rd party specialists like Manolete to handle, rather than funding them themselves.

But how quickly is this translating into revenues for Manolete ? The good news is its just starting to come through. Following the tail end disruption from Omicron, IPs are now back in the office and passing far more work onto Manolete.

That's starting to appear in its results - today it's reported FY22 figures in line with expectations, with adjusted EBIT of £5.3m on sales of £20.4m, a positive start to the new year and an optimistic outlook, pointing to the fact that “new enquiries have been rising at an increasingly faster pace….with 61 in May’22, the highest level since Jul’20”.

Equally, FY22 gross cash collections were excellent too, up 28% to £15.5m (versus £12.2m in FY21). Alongside the settlement of a large one-off £9.5m deal in April, proforma net debt should have now reduced to less than £6.0m against the £11.1m year end position.

That balance sheet improvement gives it significant capacity to fund future growth in its investment book (272 cases worth £45.7m in Mar22) as it carefully ‘cherry picks’ new work.

CEO Steven Cooklin commented: “The number of UK company insolvencies, particularly CVLs, has returned to pre-pandemic levels for an extended period. I am pleased to report that this is starting to reflect in the numbers of our monthly enquiries.”

So how much is the stock worth? Well assuming things go to plan, then I estimate MANO should be able to deliver £13m-£15m of EBIT by FY25. On a 13x-15x multiple that would imply a theoretical price of 380p-500p/share vs 290p today, offering considerable upside for long term investors, also supported by 96p/share of NTAV.