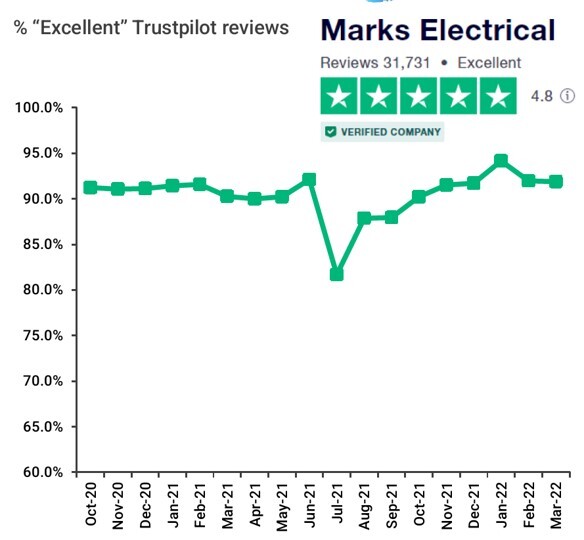

The world's best online retailers are laser focused about customer service. Marks Electrical Group plc (MRK ) – a digitally native firm, offering premium household appliances (eg cookers, TVs, fridges, freezers, etc) - is no different, scoring 4.8 out of 5.0 on Trustpilot.

In fact, I’ve just bought a new dishwasher from them at a terrific price, including next day delivery & fitting - with the old ‘broken-down’ machine being removed & fully recycled. 10 out of 10.

Sure this zealous attention to detail is often taken for granted, yet equally it’s fiendishly difficult to consistently achieve.

No wonder, more & more consumers are becoming repeat purchasers and brand endorsers - recommending the website to their friends & family.

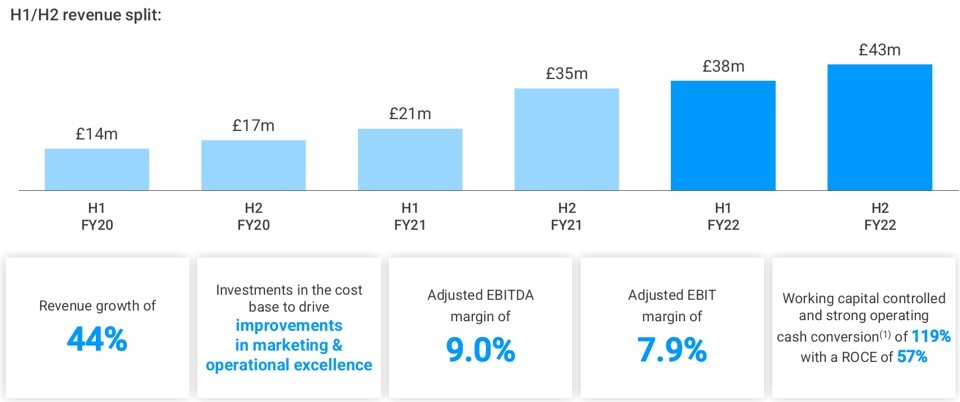

Indeed this was demonstrated again with today’s industry-beating results & ‘on track’ guidance. Posting adjusted FY22 EPS & EBITDA of 5p & £7.2m respectively (9% margin) on sales up 44% LFL to £80.5m (vs tough comparatives) - alongside 119% cash conversion & Mar’22 net cash of £3.9m.

Further adding that YTD’23 top line growth had impressively “exceeded 20%” – despite increased competition within the £5.4bn UK MDA sector.

Nonetheless this is just the tip.

CEO & founder Mark Smithson wants to ultimately lift turnover to £540m - equivalent to a 10% market share vs 1.6% currently (1.2% LY). Which assuming a sustainable 8% EBITDA margin and a 10x-12x multiple, would generate a hypothetical 400p-490p/share valuation.

Mr Smithson commenting: ”While we are conscious of the challenges [ahead], our low-cost & execution-focused model leaves us well positioned to manage operationally".

"We have continued to achieve share gains & strong revenue [since] year end - as our leading customer service & free next day delivery continues to provide a compelling & unique offer that sets us apart from the competition."

Better still, MRK provides downside resilience too. With 80% of sales coming from distressed purchases [ie appliance breakdowns like mine], providing a defendable position during the cost of living crisis.

Wrt analyst expectations, Equity Development are predicting FY23 turnover, adjusted EBITDA & EPS of £94m (+16.8%), £8.2m (8.7%) & 5.3p respectively, on top of a 150p/share valuation.