[source: Crestchic]

Sure one data point may not make a trend. However several profit upgrades all in a row is difficult to ignore.

That is exactly what Northbridge Industrial (NBI ) has achieved. Posting strong 2021 results today, alongside better than anticipated Q1’22 trading. It’s not difficult to see why either - given by buoyant rental & sales demand for its premium loadbanks that are used to test & commission backup power supplies.

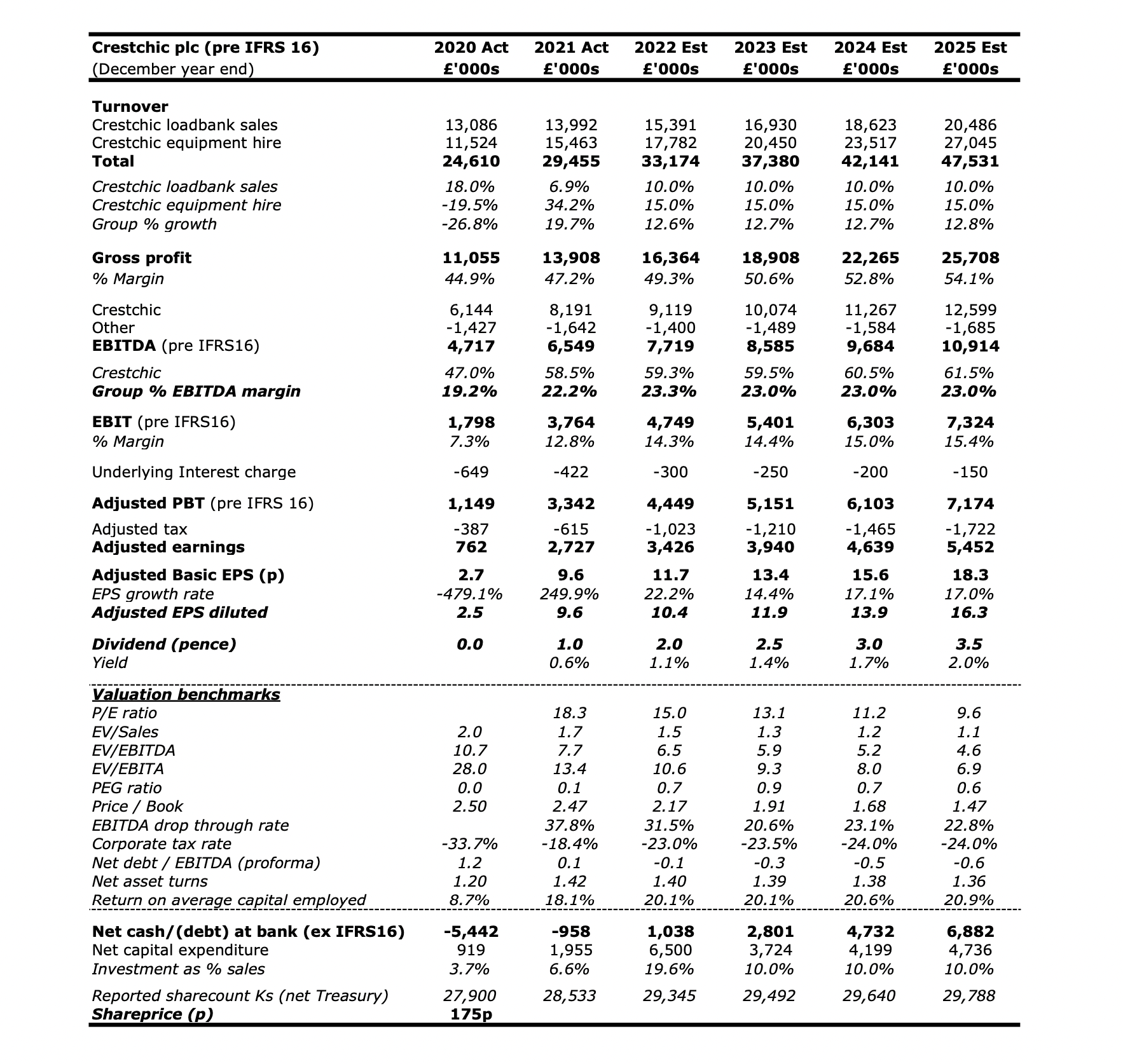

Here FY21 adjusted PBT came in at £3.3m on turnover up 19.7% to £29.5m. In fact volumes would have been even higher, had production not been capacity constrained. Ending Dec’21 with another record orderbook (4th in succession) – underpinned by numerous tailwinds, such as data centres, climate change, grid instability, renewables, geographic expansion & complementary/new products (eg transformers, heat load testing, etc).

Indeed these robust, secular trends have led to its Burton-on-Trent factory being expanded by 60%, with the extra throughput scheduled to come on-stream by June.

Granted there has been some input cost pressure due to higher commodity prices, freight rates, labour, etc. Yet equally, this has now been passed-on, indicating robust pricing power. Plus the non-core Australian/NZ Tasman unit has been sold for £4.1m, with the group also planning to change its name to Crestchic at the AGM on 9th June.

Elsewhere, FY21 gross margins & ROCE climbed to 47.2% (vs 44.9% LY) & 18% (9%) respectively, thanks primarily to improved mix (Hire fleet at 58% GM vs 35% for sales). Whilst Dec’21 net debt fell to £1m vs £5.4m LY, which has recently been eliminated following the Tasman disposal.

So what does this all mean?

Well wrt the numbers, I’ve raised both my FY22 adjusted EBITDA (pre-IRFS16) & PBT forecasts by c.10% to £7.7m and £4.45m on revenues of up 12.6% to £33.2m. Similarly driving my valuation range to between 245p-270p/share, based on a 9x-10x EV/EBITDA multiple & a 10% post tax cost of capital.

Here I believe the premium rating is more than justified mirroring Crestchic’s powerful growth drivers and long life rental assets (ie c. 20 years reflecting few/no moving parts) that require far less replacement capex than many of its plant hire peers (eg renting out power tools, diggers, etc).

Exec Chairman Peter Harris adding:

“In particular the factory expansion, growing the rental fleet and developing our systems infrastructure. All of this should build on the foundations that we have already put in place for long-term growth to deliver a strong performance in 2022 and onwards.”

The future’s bright, the future’s Crestchic.