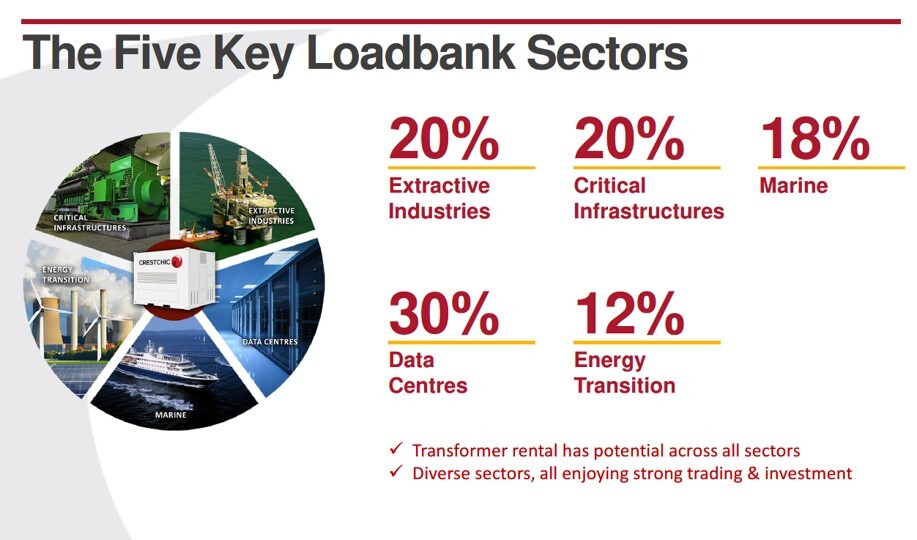

Some of the most enduring trends over the next decade will continue to be digitisation, renewable energy, and electrification. Northbridge Industrial (NBI) (soon to be renamed Crestchic) is benefiting from all three, as it demonstrated again in a positive trading update this morning.

It said that it expects 2022 results to be “ahead of expectations”, thanks to improved visibility and ongoing strong demand for its mission-critical loadbanks that are used to test and commission backup power supplies in applications that require high network reliability such as data centres and energy transition projects.

Its new factory facility is also now up & running - completed on budget and schedule - which will ultimately increase loadbank capacity by 60% at Burton-on-Trent. Northbridge said that it was facing input cost pressures due to higher commodity prices, freight rates and wages, but had been able to mitigate this via compensatory price rises and efficiency measures to protect profit margins.

Elsewhere, the last bits and pieces of the Tasman disposal in the Middle East should be finalised over the summer, with the group also planning to change its name to Crestchic (new ticker #LOAD) at the AGM later today.

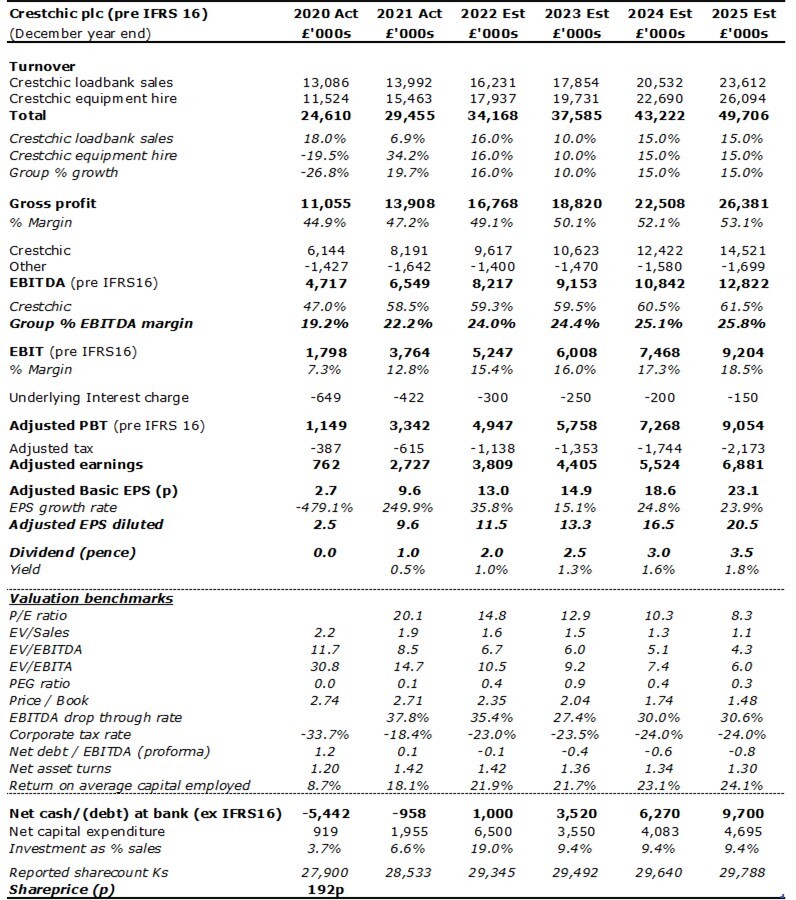

Putting all this together, my FY22 adjusted EBITDA (pre-IRFS16) & PBT forecasts have been duly lifted to £8.2m (vs £65m LY) and £4.9m (£3.3m LY) respectively on revenues up 16% YoY to £34.1m (£29.5m LY). That lifts my valuation to between 260p-290p/share, based on a 9x-10x EV/EBITDA multiple & a 10% post tax cost of capital.

In my view this rating is more than justified, mirroring Crestchic’s double-digit growth trajectory and long-life rental fleet (of around 20 years, reflecting machinery with few moving parts), which means far less replacement capex than many of its plant hire peers which rent out equipment like tools and diggers.

Executive Chairman Peter Harris commented: “We remain very confident in our strategy, the strength of our markets and our prospects for continued growth as we step forward as Crestchic.”