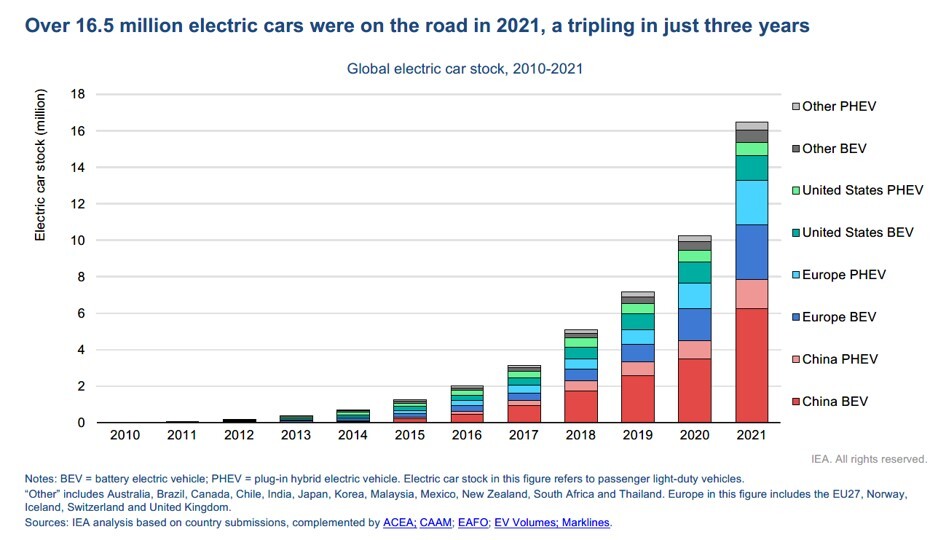

Sales of electric vehicles (EVs) are going through the roof, doubling globally in 2021 to a record 6.6m units (see chart), and up another 75% in Q122 to 2m. It's not just cars either, but also trucks, buses, vans, 2/3 wheelers & motor boats.

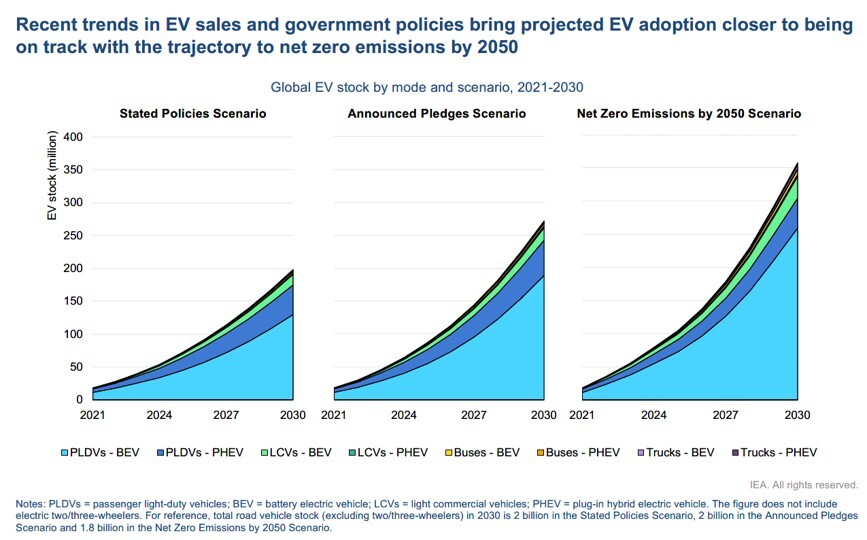

However, this is just the start of a multi-decade transition to all things electric (see chart) on the back of government subsidies, decarbonisation, superior performance and more recently the rocketing cost of hydrocarbons.

That's triggered a race by OEMs to get their products to market as soon as possible. Tesla is leading the charge, albeit there are 100s of other manufacturers seizing the opportunity too. The quickest, cheapest and - most importantly - safest way of launching EVs is to use integrated subsystems, rather than assembling them from 1,000s of individual parts, thus expediting the whole R&D, testing & 'go-to-market' strategy, alongside simplifying the supply chain and production processes, and significantly reducing the overall cost to boot.

In this context Saietta Electric Drive (SED), a leading Axial Flux electric motor developer, said today that it was seeing strong demand for its patented AF140 Motors used in light-duty vehicles (4 contracts signed already), fully integrated e-drive systems (combining motors, powertrain electronics, gearboxes, axles & inverters) and ‘Propel’ branded engines for boats.

The only problem - a 'nice-to-have' one - is coping with so much interest. Consequently the company has decided to prioritise where there is greatest 'bang for the buck'. That will see it scale back the scope of its planned durability test centre, with the resource being reallocated elsewhere.

In my view this makes perfect sense and should enable SED to accelerate its own commercialization strategy. But how big could the business ultimately become? Well hypothetically, if it were to win a 5% share (2m units pa) by 2030, then this could represent $60m-$90m of EBITDA. If rated on a 15x EBITDA multiple, that would theoretically produce a $900m-$1.35bn valuation, equivalent to £7-£11/share against the current price of 145p.

CEO Wicher Kist commented: "We are delighted that we are now in a position to offer customers fully integrated AFT e-drive system solutions. The acquisition of e-Traction has enabled us to reach this point sooner than expected, and customer engagement has convinced us that this is the best commercial opportunity for delivering our AFT technology to market.

"We are also delighted that we can now manufacture these innovative products at our world-class automotive electric motor manufacturing facility in Sunderland - which has historically delivered over 25m electric motors for automotive OEMs."