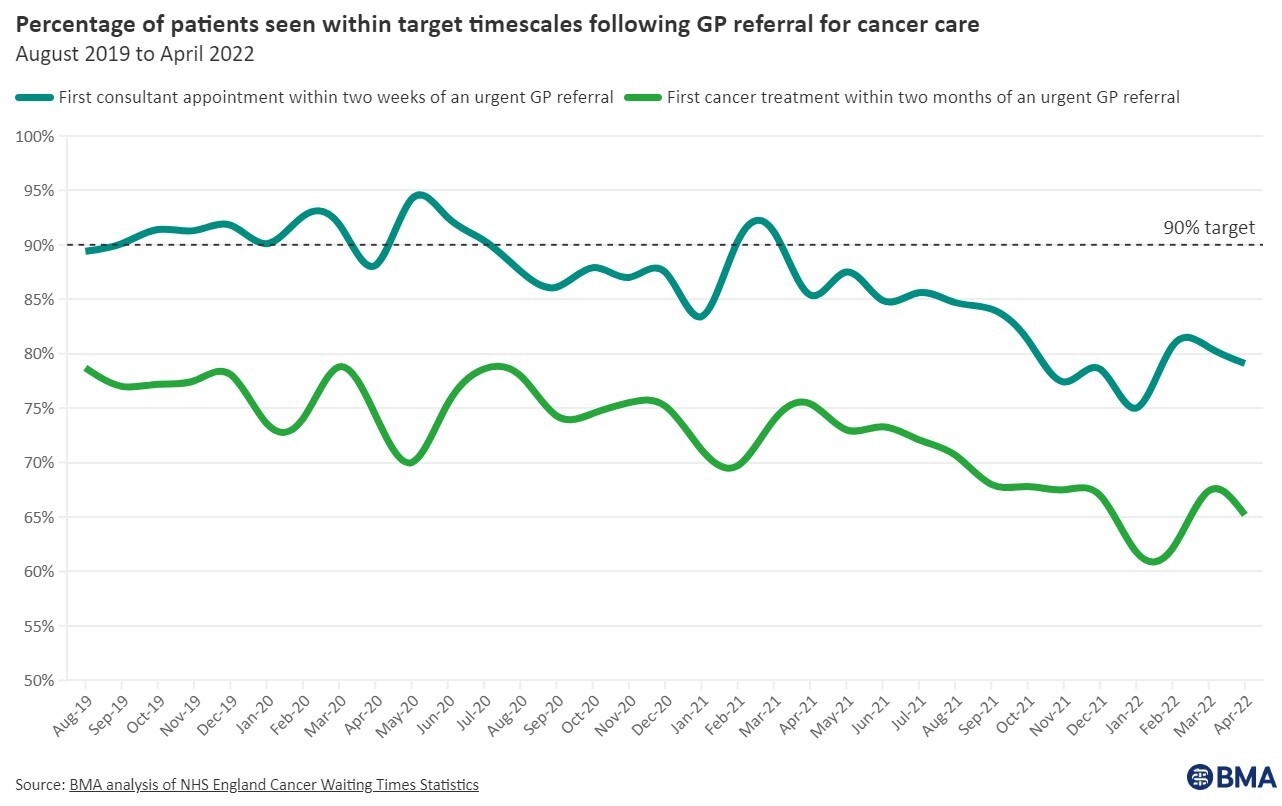

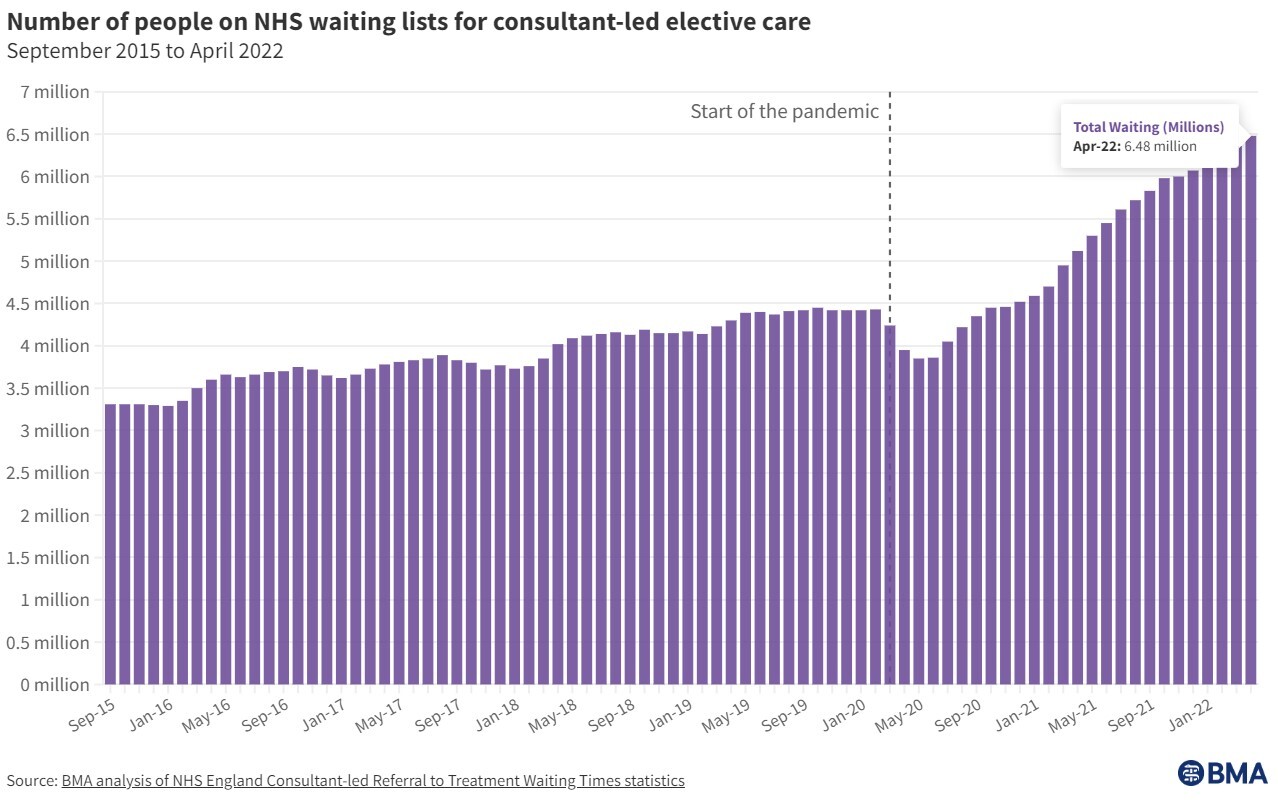

At almost every level, the NHS is struggling. Waiting lists for elective procedures have ballooned to 6.5m (see charts). Cancer referral targets are being missed and ambulances are repeatedly stacked up outside A&E departments. That's exacerbated by an acute shortage of doctors, nurses & other hospital staff.

What’s needed to fix the NHS and reduce waiting lists is not necessarily more money but a paradigm shift in how it's managed. That partly means utilising faster, more productive and best-in-class expertise.

One such group already providing this to the NHS is medical diagnostics and laboratory services company SourceBio International (SBI). And unsurprisingly, demand is for its leading cellular/digital pathology services used to test tissue samples and conduct biopsies for cancer is soaring.

It reported "record" sales - up an estimated 130% in H1 2022 to £6.8m on a like-for-like basis (from £2.9m proforma last year), reflecting what it described as “exceptionally strong” conditions created by the “continued shortage of [NHS] pathologists coupled with the increasing momentum of elective surgeries”.

The challenge going forward is to materially ramp up capacity to satisfy this soaring demand, most likely via a combination of productivity improvements that speed up turn-around times, new technology including AI, all underpinned by greater investment.

But that’s not all. The Genomics and Stability Storage divisions also expanded H1 2022 revenues – up 11% and 9% respectively to c. £3m and £4m. That meant that core turnover was up 63% in aggregate to £13.8m (42% LFL), on top of £6.6m in Covid PCR testing revenues and total adjusted EBITDA of £2.1m.

The company did incur a £2.5m charge covering one-off restructuring, inventory and M&A expenses related to the £18.5m LDPath purchase, which is 14% ahead of plan. But most of these costs have already been paid, leaving ample net cash of £15.2m or 20p a share to further accelerate organic and acquisitive growth. What's more, the 2021 tax dispute appears to be resolved, with HMRC “verbally saying it did not intend to pursue its PCR related VAT claim.”

All of that leaves SourceBio on track to hit expectations for adjusted FY 2022 EBITDA and EPS of £6.4m and 2.0p respectively, on sales of £39.5m, including more than 40% like-for-like growth in its core business). Thereafter, I reckon these 3 divisions alone (excluding Covid PCR testing) should be able to achieve £10m-£13m of EBITDA on turnover of £50m-£55m by 2025.

Assuming a 14x EV/EBITDA multiple, that would equate to a hypothetical valuation range of circa 185p-245p/share, broadly in line with broker Liberum's 210p target price - a point not missed either by exec chairman Jay Le Coque, who in April snapped up 100k shares at 129.5p, lifting his stake to 3.3%.