SP Angel . Morning View . Friday 10.10.25

Silver Squeeze as silver Lease rates jump to 35% on uber-tight physical market

MiFID II exempt information – see disclaimer below

DeSoto Resources* (DES AU) – A$14m raise

Toubani Resources (TRE AU) – Kobada Gold Project funding package for A$395m

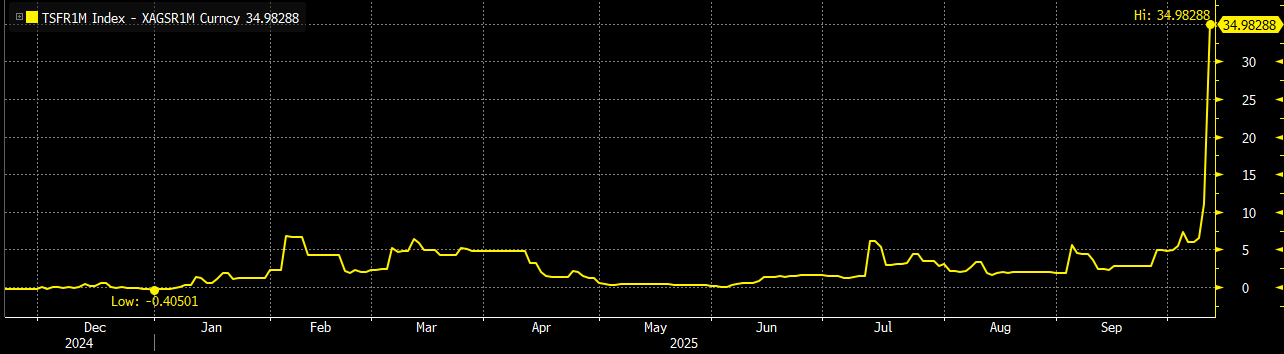

Silver ($51/oz) Silver Squeeze as silver Lease rates jump to 35% on uber-tight physical market

- Silver lease rate jumped to >19% from 5% in June and 0% at the beginning of the year. Silver lease rates normally trade at around -1%.

- The silver market is in backwardation with the spot price trading $1 over the December futures contract.

- Strong industrial demand combined with new interest in silver as a proxy for gold has raised silver prices and lease rates

- Demand for silver in solar panels and in EV power trains has outstripped all expectations

- Silver ETF inflows have added the shortage of physical metal as investors buy-up the market

- US Tariff concerns caused traders to move some physical silver into the US adding to the shortage of available metal.

Gold (US$3,979/oz) – Asian trade supported but did not lift gold overnight with prices crashing in NY trade

- Gold had a big and a bad day yesterday reaching a peak of $4,059/oz in London trade before crashing back to $3,948/oz in NY trading.

- That’s >$100/oz of volatility in the space of four hours with support said to be at $3,800/oz.

- We normally like to work off fundamental analysis but with gold we can’t see what the Central Banks are doing on a day-to-day basis.

- Gold ETF buying appears to have slowed and it may be time for the market to pause and digest the mammoth $650/oz run over the past six weeks and $1,374/oz yoy gain.

- Key drivers:

- Outlook for US Fed interest rates,

- China dumping US dollars and related instruments, perhaps Trade deal related,

- BRICS and other Central banks switching into gold in the absence of other tangible and liquid hard assets,

- ETF institutional and private investor buying. ETF have made it much easier for investors to buy and sell gold-based instruments,

- Trump’s Big Beautiful Bill indicates more money printing,

- US Government shutdown,

- US Trade Tariffs and trade disputes,

- China pushing to denominate trade into China in Yuan and avoid US dollars,

- BHP just agreed with China Mineral Resource Group (China state trader) to settle 30% of its spot trade with China using CFR-based prices at Chinese ports in RMB.

- Concerns over US Tech valuations - We feel they are high but also earnings growth lending support,

- French inability to agree a budget or even maintain a Prime Minister.

- Physical gold production:

- Mali: Collapsing gold production in Mali and potential for further attacks in Burkina Faso by Al-Queda linked insurgents,

- Grasberg mud rush stopped copper and gold production. Grasberg produced 19moz of gold last year.

- Thoughts:

- It’s dangerous to bet against the US dollar and the US market and it is possible that Republican Tariff policies might create more value and jobs than many Democrats predict.

- China and Russia are working to undermine the dominance of the US$ but Russia is increasingly irrelevant, and China is also suffering from substantial internal debt and corruption.

Conclusion: Gold may retrace some of its gains in an increasingly volatile trading environment, but it is normal for the metal to hold onto most of its gains.

Even at a $300-500/oz retracement most gold miners are worth a multiple of where they were six weeks ago with many gold miners entirely unhedged.

Ready-to-go gold projects like Kefi Minerals* in Ethiopia should be able to sell forward production to guarantee substantially higher cash flow and compete their project financing.

Forward gold sales will take some of the heat of the market but the gold price run but it will take months / years for many new projects to be ready for forward sales.

Newmont and Barrick Gold have clear policies not to hedge gold but some other miners may sell some production forward into the market to lock in future cash flow.

SP Angel acts as Nomad and broker to Kefi Minerals*

Nobel Peace Prize awarded to Maria Corina Machado for her work promoting democratic rights in Venezuela

- Maria Corina Machado is the most influential opposition leader in Venezuela gets the award.

- The Committee commended Machado as a “brave and committed champion of peace” who “keeps the flame of democracy burning during a growing darkness”.

- Machado was a favourite to receive the award with Trump odds running at <5%, on Polymarket data.

- Unlucky Donald, better luck next time!

Israel – The cabinet approves the first phase of Trump’s plan to end the two year war against Hamas in Gaza.

- 48 hostages will be released on Monday or Tuesday.

- Under the agreement Israel will move its troops back from front lines to an initial redeployment line in Gaza as ceasefire takes effect.

- Additionally, Israel will release almost 2,000 Palestinian prisoners including 250 serving life sentences.

- The next step would the second phase that includes the disarmament of Hamas, the deployment of international stabilisation force and staggered withdrawal of Israeli troops from Gaza.

IG TV Commodity Corner: (Tuesday 7/10/25) https://www.youtube.com/watch?v=u7en9LCuurE

| Dow Jones Industrials | -0.52% | at | 46,358 | |

| Nikkei 225 | -1.01% | at | 48,089 | |

| HK Hang Seng | -1.82% | at | 26,266 | |

| Shanghai Composite | -0.94% | at | 3,897 | |

| US 10 Year Yield (bp change) | -2.7 | at | 4.11 |

Currencies

US$1.1577/eur vs 1.1611/eur previous. Yen 152.85/$ vs 153.09/$. SAr 17.255/$ vs 17.200/$. $1.330/gbp vs $1.335/gbp. 0.655/aud vs 0.658/aud. CNY 7.125/$ vs 7.128/$.

Dollar Index 99.34 vs 99.01 previous.

Precious metals:

Gold US$3,979/oz vs US$4,030/oz previous

Gold ETFs 97.4moz vs 97.4moz previous

Platinum US$1,610/oz vs US$1,660/oz previous

Palladium US$1,413/oz vs US$1,458/oz previous

Silver US$50.5/oz vs US$49.1/oz previous

Rhodium US$7,225/oz vs US$7,150/oz previous

Base metals:

Copper US$10,759/t vs US$10,871/t previous

Aluminium US$2,778/t vs US$2,780/t previous

Nickel US$15,350/t vs US$15,500/t previous

Zinc US$3,008/t vs US$3,029/t previous

Lead US$2,028/t vs US$2,026/t previous

Tin US$36,630/t vs US$36,705/t previous

Energy:

Oil US$64.9/bbl vs US$66.4/bbl previous

- International energy prices edged lower on reduced geopolitical risk after the Israeli government approved a ceasefire deal with Hamas to withdraw its troops and release Palestinian prisoners in return for the release of Israeli hostages.

- US Henry Hub natural gas prices also declined as the EIA reported an 80bcf w/w build to 3,641bcf (+75bcf expected), with storage inventories 0.6% above last year’s level and 4.5% above the 5-year average.

- The EIA expects the USA will add 5bcf/d in LNG export capacity in 2025 and 2026 as Plaquemines LNG and Corpus Christi LNG Stage 3 projects come online, which will grow average exports to 14.7bcf/d in 2025 and to 16.3bcf/d in 2026

- The International Chamber of Commerce International Court of Arbitration found that Venture Global breached its obligations to BP to declare commercial operations had begun at the Calcasieu Pass plant in a timely manner and act as a reasonable and prudent operator. There is no indication as to why this contradicts the prior arbitration involving Shell.

Natural Gas €32.1/MWh vs €32.3/MWh previous

Uranium Futures $77.7/lb vs $77.7/lb previous

Bulk:

Iron Ore 62% Fe Spot (Singapore) US$105.7/t vs US$104.9/t

Chinese steel rebar 25mm US$448.6/t vs US$448.5/t

HCC FOB Australia US$190.3/t vs US$190.0/t

Thermal coal swap Australia FOB US$106.5/t vs US$105.5/t

Other:

Cobalt LME 3m US$41,865/t vs US$40,420/t

NdPr Rare Earth Oxide (China) US$79,088/t vs US$78,845/t

Lithium carbonate 99% (China) US$10,007/t vs US$10,003/t

China Spodumene Li2O 6%min CIF US$830/t vs US$830/t

Ferro-Manganese European Mn78% min US$1,015/t vs US$1,015/t

China Tungsten APT 88.5% FOB US$593/mtu vs US$593/mtu

China Tantalum Concentrate 30% CIF US$93/lb vs US$93/mtu

China Graphite Flake -194 FOB US$400/t vs US$400/t

Europe Vanadium Pentoxide 98% US$5.4/lb vs US$5.4/lb

Europe Ferro-Vanadium 80% US$23.6/kg vs US$23.6/kg

China Ilmenite Concentrate TiO2 US$273/t vs US$270/t

US Titanium Dioxide TiO2 >98% US$2,979/t vs US$2,979/t

China Rutile Concentrate 95% TiO2 US$1,102/t vs US$1,101/t

Spot CO2 Emissions EUA Price US$65.1/t vs US$65.1/t

Brazil Potash CFR Granular Spot US$352.5/t vs US$352.5/t

Germanium China 99.99% US$3,075.0/kg vs US$3,075.0/kg

China Gallium 99.99% US$400.0/kg vs US$400.0/kg

EV & battery news

Mercedes-Benz unveils new ELF experimental charging vehicle

- Mercedes-Benz has developed and new prototype EV, dubbed ELF (Experimental-Lade-Fahrzeug/Experimental Charging Vehicle), designed to test next-generation charging technologies.

- ELF is looking to test megawatt-level fast charging, wireless inductive systems, bidirectional V2G/V2H (vehicle-to-grid/vehicle-to-home) capability, and solar integration in one platform.

- The vehicle is equipped with MCS and CCS connectors and supports up to 900kW charging, adding 100kWh power in 10 minutes. Current EV battery capacity averages between 40-60kWh.

- Tests also include inductive and automated conductive charging aimed at improving convenience, safety and accessibility.

- Mercedes plans to roll out bidirectional charging in 2026 in Germany, France, and the UK, claiming potential household energy savings of about $580 per year.

| Overnight Change | Weekly Change | Overnight Change | Weekly Change | ||

| BHP | -2.1% | 0.3% | Freeport-McMoRan | 1.1% | 11.4% |

| Rio Tinto | -1.7% | 0.1% | Vale | -0.6% | 0.1% |

| Glencore | -0.9% | 1.8% | Newmont Mining | -3.6% | -1.4% |

| Anglo American | -1.1% | 4.2% | Fortescue | -1.5% | -0.7% |

| Antofagasta | -1.3% | 0.6% | Teck Resources | 2.5% | 1.6% |

Company news

DeSoto Resources* (DES AU) A$0.21, Mkt Cap A$34m – A$14m raise

- The Company raised A$14m at A$0.16 to progress exploration at he Siguiri Basin in Guinea.

- Maiden RC drilling programme is underway.

- 10,000m planned at Dadjan with further drilling to move to the large targets at the Tole and Timbakouna projects.

- The raise was supported by a A$5m cornerstone order from Tony Poli, an early investor in Predictive Discovery.

- The Company has A415.5m in cash post raise.

*An SP Angel analyst holds shares in Desoto Resources

Toubani Resources (TRE AU) A$0.45, Mkt Cap A$149m – Kobada Gold Project funding package for A$395m

- The Company closed A$395m funding package for the Kobada Gold Project in Mali.

- The package includes A$242m (US$160m) Eagle Eye Asset Gold Stream

- EEA to purchase 11.1% of gold produced from existing licenses at 20% of the spot gold price

- A$125m equity raise (312m at A$0.40/share) with EEA participating pro rata (A$45m)

- Offer price represents a 6% discount to the last close price.

- A$26m worth of options (78.2m options at A$0.336/sh exercise) exercised by EEA with its stake in the Company rising to 35% (post raise)

- Along A$26m in cash, the funding package makes the Kobada Gold Project fully funded.

- Project FID due 4Q25, construction start 1Q26 and first gold 3Q27.

- Kobada DFS:

- MRE 78mt at 0.88g/t for 2.2moz (incl of reserves)

- PP 54mt at 0.90g/t for 1.6moz

- Free dix oxide operation, 3.0 WO

- 6mtpa over ~9y LOM

- 162kozpa

- US$1,175/oz AISC

- US$216m development capex

- Post tax NPV8 and IRR $500m and 50% ($2,200/oz)

- Post tax NPV8 and IRR $951m and 79% ($3,000/oz)

LSE Group Starmine awards for 2025 / 2024 commodity forecasting:

No.1 in Precious Metals: SP Angel mining team awarded No 1. ranking for Precious Metals forecasting in LSEG Annual Starmine Award for Reuters Polls for Q1 2025

No.1 in Precious Metals: SP Angel mining team awarded No 1. ranking for Precious Metals forecasting in LSEG Annual Starmine Award for Reuters Polls 2024

No.2 in Base Metals: SP Angel mining team awarded No 2. ranking for Base Metals forecasting in LSEG Annual Starmine Award for Reuters Polls 2024

Analysts

John Meyer –John.Meyer@spangel.co.uk – 0203 470 0490

Simon Beardsmore – Simon.Beardsmore@spangel.co.uk – 0203 470 0484

Sergey Raevskiy –Sergey.Raevskiy@spangel.co.uk - 0203 470 0474

Arthur Parish – Arthur.Parish@spangel.co.uk – 0203 470 0476

Sales

Richard Parlons –Richard.Parlons@spangel.co.uk - 0203 470 0472

Abigail Wayne –Abigail.Wayne@spangel.co.uk - 0203 470 0534

Rob Rees –Rob.Rees@spangel.co.uk - 0203 470 0535

Grant Barker – Grant.Barker@spangel.co.uk – 0203 470 0471

George Krokos - george.krokos@spangel.co.uk – 0203 470 0486

Prince Frederick House

35-39 Maddox Street

London, W1S 2PP

*SP Angel are the No1 integrated nomad and broker by number of mining brokerage clients on AIM according to the AIM Advisers Ranking Guide (joint brokerships excluded)

+SP Angel employees may have previously held, or currently hold, shares in the companies mentioned in this note.

| Sources of commodity prices | |

| Gold, Platinum, Palladium, Silver | BGNL (Bloomberg Generic Composite rate, London) |

| Gold ETFs, Steel | Bloomberg |

| Copper, Aluminium, Nickel, Zinc, Lead, Tin, Cobalt | LME |

| Oil Brent | ICE |

| Natural Gas, Uranium, Iron Ore | NYMEX |

| Thermal Coal | Bloomberg OTC Composite |

| Coking Coal | SSY |

| RRE | Steelhome |

| Lithium Carbonate, Ferro Vanadium, Tungsten, Spodumene, Ferro-Manganese, Graphite, Rutile | Asian Metal |

DISCLAIMER

This note is a marketing communication and comprises non-independent research. This means it has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

This note is intended only for distribution to Professional Clients and Eligible Counterparties as defined under the rules of the Financial Conduct Authority and is not directed at Retail Clients.

This note is confidential and is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published in whole or in part, for any purpose.

This note has been issued by SP Angel Corporate Finance LLP (‘SPA’) to promote its investment services. Neither the information nor the opinions expressed herein constitutes, or is to be construed as, an offer or invitation or other solicitation or recommendation to buy or sell investments. The information contained herein is based on sources which we believe to be reliable, but we do not represent that it is wholly accurate or complete. All opinions and estimates included in this report are subject to change without notice. It is not investment advice and does not take into account the investment objectives and policies, financial position or portfolio composition of any recipient. SPA is not responsible for any errors or omissions or for the results obtained from the use of such information. Where the subject of the research is a client company of SPA we may have shown a draft of the research (or parts of it) to the company prior to publication to check factual accuracy, soundness of assumptions etc.

Distribution of this note does not imply distribution of future notes covering the same issuers, companies or subject matter.

Where the investment is traded on AIM it should be noted that liquidity may be lower and price movements more volatile.

SPA, its partners, officers and/or employees may own or have positions in any investment(s) mentioned herein or related thereto and may, from time to time add to, or dispose of, any such investment(s).

SPA is registered in England and Wales with company number OC317049. The registered office address is Prince Frederick House, 35-39 Maddox Street, London W1S 2PP. SPA is authorised and regulated by the UK Financial Conduct Authority and is a Member of the London Stock Exchange plc.

MiFID II - Based on our analysis we have concluded that this note may be received free of charge by any person subject to the new MiFID II rules on research unbundling pursuant to the exemptions within Article 12(3) of the MiFID II Delegated Directive and FCA COBS Rule 2.3A.19.

A full analysis is available on our website here http://www.spangel.co.uk/legal-and-regulatory-notices.html. If you have any queries, feel free to contact our Compliance Officer, Tim Jenkins (tim.jenkins@spangel.co.uk).

SPA research ratings – Based on a time horizon of 12 months: Buy = Expected return of more than 15%, Hold = Expected return between -15% and +15%, Sell = Expected return

SP Angel Corporate Finance LLP is authorised and regulated by the Financial Conduct Authority and is a Member of the London Stock Exchange.

Disclaimer

The information contained in this communication from the sender is confidential. It is intended solely for use by the recipient and others authorized to receive it. If you are not the recipient, you are hereby notified that any disclosure, copying, distribution or taking action in relation of the contents of this information is strictly prohibited and may be unlawful.

This email has been scanned for viruses and malware, and may have been automatically archived by Mimecast Ltd, an innovator in Software as a Service (SaaS) for business. Providing a safer and more useful place for your human generated data. Specializing in; Security, archiving and compliance. To find out more Click Here.